NVIDIA 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

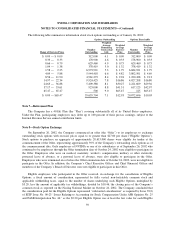

who are not directors, officers or 10% stockholders. The 2000 Plan provides for the issuance of nonstatutory

stock options, stock bonuses and restricted stock purchase rights. Options generally expire in 10 years. The

Compensation Committee appointed by the Board of Directors has the authority to amend the 2000 Plan and to

determine the option term, exercise price and vesting period of each grant. Options generally vest ratably over a

four-year period, with 25% becoming vested approximately one year from the date of grant and the remaining

75% vesting on a quarterly basis over the next three years. Subsequent grants generally vest quarterly over a

four-year period. A total of 21,939,202 shares were authorized for issuance under the 2000 Plan. There were

10,720,060 shares available for future issuance as of January 26, 2003.

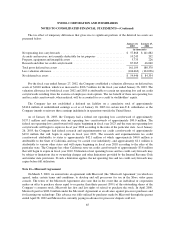

1998 Equity Incentive Plan

The Equity Incentive Plan (the “1998 Plan”) was adopted by the Company’s Board of Directors on February

17, 1998 and was approved by the Company’s stockholders on April 6, 1998 as an amendment and restatement

of the Company’s then existing Equity Incentive Plan which had been adopted on May 21, 1993. The 1998 Plan

provides for the issuance of the Company’s common stock to directors, employees and consultants. The 1998

Plan provides for the issuance of stock bonuses, restricted stock purchase rights, incentive stock options or

nonstatutory stock options. On the last day of each fiscal year, starting with the year ending January 31, 1999, the

aggregate number of shares of common stock that are available for issuance are automatically increased by a

number of shares equal to five percent (5%) of the Company’s outstanding common stock on such date,

including on an as-if-converted basis preferred stock and convertible notes, and outstanding options and

warrants, calculated using the treasury stock method. There are a total of 101,298,229 shares authorized for

issuance and 21,265,519 shares are available for future issuance as of January 26, 2003.

Pursuant to the 1998 Plan, the exercise price for incentive stock options is at least 100% of the fair market

value on the date of grant or for employees owning in excess of 10% of the voting power of all classes of stock,

110% of the fair market value on the date of grant. For nonstatutory stock options, the exercise price is no less

than 85% of the fair market value on the date of grant.

Options generally expire in 10 years. Vesting periods are determined by the Board of Directors. However,

the initial options granted generally vest ratably over a four year period, with 25% becoming vested

approximately one year from the date of grant and the remaining 75% vesting on a quarterly basis over the next

three years. Subsequent grants generally vest quarterly over a four year period. Options granted prior to

December 1997 could be exercised prior to full vesting. Any unvested shares so purchased were subject to a

repurchase right in favor of the Company at a repurchase price per share that was equal to the original per share

purchase price. The right to repurchase at the original price would lapse at the rate of 25% per year over the four-

year period from the date of grant. As of January 26, 2003, there were no shares subject to repurchase.

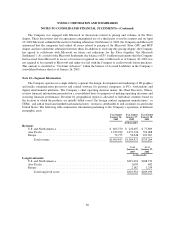

1998 Non-Employee Directors’ Stock Option Plan

In February 1998, the Company’s Board of Directors adopted the 1998 Non-Employee Directors’ Stock

Option Plan (the “Directors Plan”) to provide for the automatic grant of non-qualified options to purchase shares

of the Company’s common stock to directors of the Company who are not employees or consultants of the

Company or of an affiliate of the Company. The Directors Plan was amended on May 22, 2002.

Under the amended Directors Plan, each non-employee director who is elected or appointed to the

Company’s Board of Directors for the first time is automatically granted an option to purchase 75,000 shares,

which vests quarterly over a three-year period (“Initial Grant”). Previously, such a director was entitled to a grant

of 200,000 shares, vesting monthly over a four-year period.

56