NVIDIA 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

period, except for those expenses related to the previously noted balance sheet amounts, which are remeasured at

historical exchange rates. Gains or losses from foreign currency remeasurement are included in “Interest and

other income, net” and to date have not been significant.

Comprehensive Income

Comprehensive income consists of net earnings and unrealized gains and losses on available-for-sale

securities, recorded net of tax.

Goodwill and Intangible Assets

Effective fiscal 2003, the Company completed the adoption of Statement of Financial Accounting Standards

No. 142 (“SFAS No. 142”), Goodwill and Other Intangible Assets. As required by SFAS No. 142, the Company

discontinued amortizing the remaining balances of goodwill as of the beginning of fiscal 2003. All remaining and

future acquired goodwill will be subject to impairment tests annually, or earlier if indicators of potential

impairment exist, using a fair-value-based approach. All other intangible assets will continue to be amortized

over their estimated useful lives and assessed for impairment under SFAS No. 144, Accounting for the

Impairment or Disposal of Long-Lived Assets.

In conjunction with the implementation of SFAS No. 142, during the first quarter of fiscal 2003 the

Company completed a transitional goodwill impairment test and concluded that no impairment was indicated.

Upon adoption of the new business combination rules, acquired workforce no longer met the definition of an

identified intangible asset. As a result, the net balance of $1.8 million was reclassified to goodwill in fiscal 2003.

The adoption of SFAS No. 142 ceased the amortization of goodwill, which otherwise would have been

approximately $13.0 million for the year ended January 26, 2003. In accordance with SFAS No. 142, the

Company has elected to perform its annual impairment review during the fourth quarter. The Company has

completed its annual goodwill impairment test and concluded that there was no impairment. The effects of the

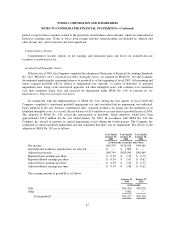

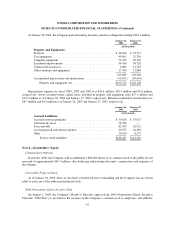

adoption of SFAS No. 142 are as follows:

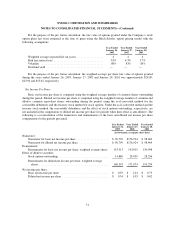

Year Ended

January 26,

2003

Year Ended

January 27,

2002

Year Ended

January 28,

2001

(in thousands, except per share data)

Net income .......................................... $90,799 $176,924 $98,469

Goodwill and workforce amortization, tax effected ........... $ — $ 7,065 $ —

Adjusted net income ................................... $90,799 $183,989 $98,469

Reported basic earnings per share ........................ $ 0.59 $ 1.24 $ 0.75

Reported diluted earnings per share ....................... $ 0.54 $ 1.03 $ 0.62

Adjusted basic earnings per share ........................ $ 0.59 $ 1.29 $ 0.75

Adjusted diluted earnings per share ....................... $ 0.54 $ 1.08 $ 0.62

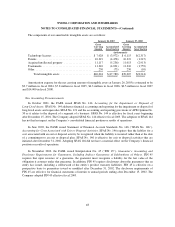

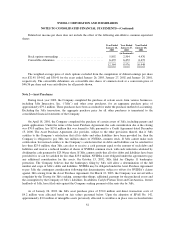

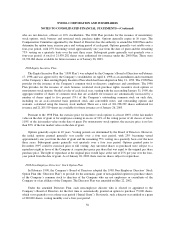

The carrying amount of goodwill is as follows:

January 26,

2003

January 27,

2002

(in thousands)

3dfx ........................................................... $50,326 $50,326

Other .......................................................... 3,901 —

Total goodwill ............................................... $54,227 $50,326

47