NVIDIA 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NVIDIA CORPORATION AND SUBSIDIARIES

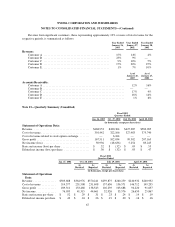

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

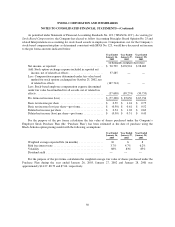

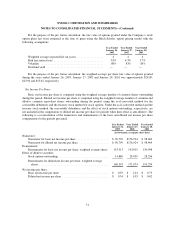

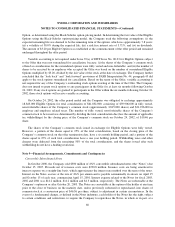

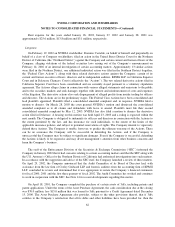

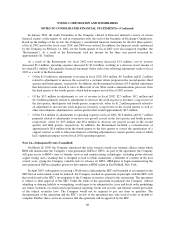

Option, as determined using the Black-Scholes option-pricing model. In determining the fair value of the Eligible

Options using the Black-Scholes option-pricing model, the Company used the following assumptions: (i) the

expected remaining life was deemed to be the remaining term of the options, which was approximately 7.8 years;

(ii) a volatility of 50.0% during the expected life; (iii) a risk-free interest rate of 3.71%; and (iv) no dividends.

The amount of $3.20 per Eligible Option was established at the commencement of the offer period and remained

unchanged throughout the offer period.

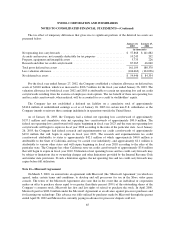

Variable accounting is not required under Issue 39(a) of EITF Issue No. 00-23 for Eligible Options subject

to the Offer that were not surrendered for cancellation, because: (i) the shares of the Company’s common stock

offered as consideration for the surrendered options were fully vested and non-forfeitable; and (ii) the number of

shares to be received by an employee who accepted the Offer was based on the number of surrendered Eligible

Options multiplied by $3.20, divided by the fair value of the stock at the date of exchange. The Company further

concluded that the “look back” and “look forward” provisions of FASB Interpretation No. 44, paragraph 45 did

apply to the stock options surrendered for cancellation. Based on the terms of the Offer, variable accounting is

not required for any of the Company’s outstanding stock options existing at the time of the Offer. The Company

does not intend to grant stock options to any participants in the Offer for at least six months following October

24, 2002. If any stock options are granted to participants in the Offer within the six months following October 24,

2002, those stock options will receive variable accounting.

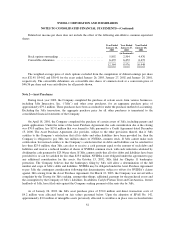

On October 24, 2002, the offer period ended and the Company was obligated to exchange approximately

18,843,000 Eligible Options for total consideration of $61,832,000, consisting of $39,906,000 in fully vested,

non-forfeitable shares of the Company’s common stock (approximately 3,815,000 shares) and $21,926,000 in

employer and employee related taxes. The number of fully vested, non-forfeitable shares of the Company’s

common stock to be issued was determined by dividing the total consideration due (less the amount of applicable

tax withholdings) by the closing price of the Company’s common stock on October 24, 2002, of $10.46 per

share.

The shares of the Company’s common stock issued in exchange for Eligible Options were fully vested.

However, a portion of the shares equal to 25% of the total consideration, based on the closing price of the

Company’s common stock on the offer termination date, have a six month holding period, and a portion of the

shares equal to 25% of such total consideration have a one year holding period. Withholding taxes and other

charges were deducted from the remaining 50% of the total consideration, and the shares issued after such

withholding do not have a holding restriction.

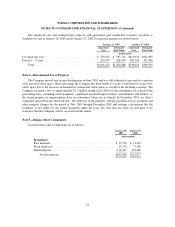

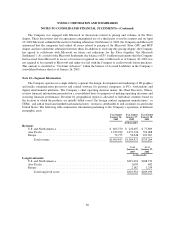

Note 9—Financial Arrangements, Commitments and Contingencies

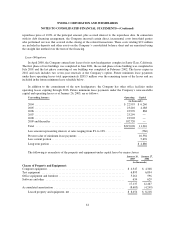

Convertible Subordinated Notes

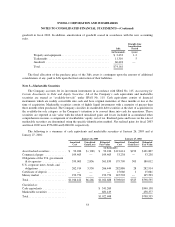

In October 2000, the Company sold $300 million of 4¾% convertible subordinated notes (the “Notes”) due

October 15, 2007. Proceeds net of issuance costs were $290.8 million. Issuance costs are being amortized to

interest expense on a straight-line basis, which approximates the interest rate method over the term of the notes.

Interest on the Notes accrues at the rate of 4¾% per annum and is payable semiannually in arrears on April 15

and October 15 of each year, commencing April 15, 2001. Interest expense related to the Notes for fiscal 2003,

2002 and 2001 was $14.2 million, $14.2 million and $4.3 million, respectively. The Notes are redeemable at the

Company’s option on or after October 20, 2003. The Notes are convertible at the option of the holder at any time

prior to the close of business on the maturity date, unless previously redeemed or repurchased, into shares of

common stock at a conversion price of $46.36 per share, subject to adjustment in certain circumstances. In the

event of a fundamental change, as defined in the Notes indenture, each holder of the Notes has the right, subject

to certain conditions and restrictions, to require the Company to repurchase the Notes, in whole or in part, at a

60