NVIDIA 2003 Annual Report Download - page 46

Download and view the complete annual report

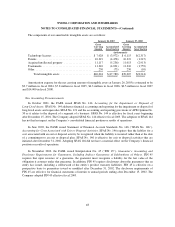

Please find page 46 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1—Organization and Significant Accounting Policies

Organization

NVIDIA Corporation and subsidiaries (the “Company”) designs, develops and markets 3D graphics and

media communication processors and related software for PCs, workstations and digital entertainment platforms.

The Company operates in one industry segment in the United States, Asia and Europe. In April 1998, the

Company was reincorporated as a Delaware corporation.

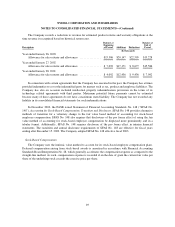

Reclassifications

Certain prior year balance sheet and income statement balances were reclassified to conform to the current

period presentation.

Principles of Consolidation

The consolidated financial statements include the accounts of NVIDIA Corporation and its wholly owned

subsidiaries. All material intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires

management to make estimates and assumptions that affect the recorded amounts of assets and liabilities, the

disclosure of contingent assets and liabilities and the reported amounts of revenues and expenses during the

reporting period. Actual results could differ from these estimates.

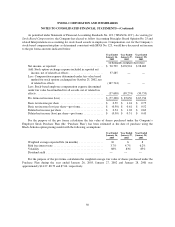

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with a maturity of three months or less at

the time of purchase to be cash equivalents. As of January 26, 2003, the Company’s cash and cash equivalents

were $347.0 million, which consists of $192.8 million invested in money market funds.

Marketable Securities

Marketable securities consist of highly liquid investments with a maturity of greater than three months when

purchased. In accordance with Statement of Financial Accounting Standards No. 115 (“SFAS No. 115”),

Accounting for Certain Investments in Debt and Equity Securities, the Company has classified all marketable

securities as available-for-sale, as the Company’s intention is to convert them into cash for operations. Such

securities are reported at fair value, with unrealized gains and losses, net of taxes, excluded from earnings and

shown separately as a component of accumulated other comprehensive income within stockholders’ equity.

Interest earned on marketable securities is included in interest income. Realized gains and losses on the sale of

marketable securities are determined using the specific-identification method.

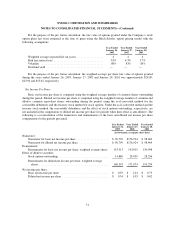

Inventories

Inventories are stated at the lower of cost on a weighted average basis, or market. Write-downs to reduce the

carrying value of obsolete, slow moving and non-usable inventory to net realizable value are charged to cost of

revenues.

44