NVIDIA 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

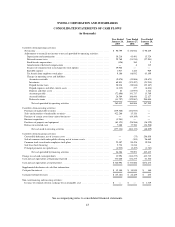

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

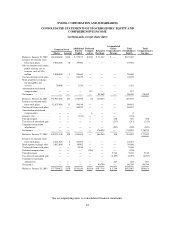

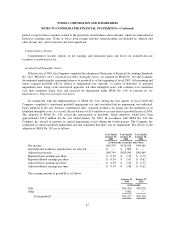

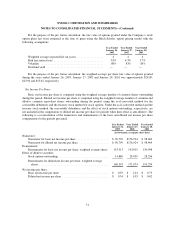

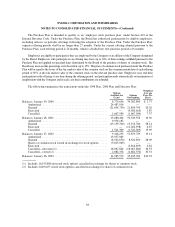

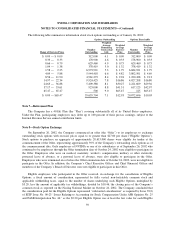

The Company records a reduction to revenue for estimated product returns and warranty obligations at the

time revenue is recognized based on historical return rates.

Description

Balance at

Beginning

of Period Additions Deductions

Balance at

End of

Period

(In thousands)

Year ended January 26, 2003

Allowance for sales returns and allowances ............... $15,586 $20,147 $22,505 $13,228

Year ended January 27, 2002

Allowance for sales returns and allowances ............... $ 7,092 $17,171 $ 8,677 $15,586

Year ended January 28, 2001

Allowance for sales returns and allowances ............... $ 4,092 $12,436 $ 9,436 $ 7,092

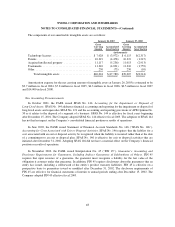

In connection with certain agreements that the Company has executed in the past, the Company has at times

provided indemnities to cover the indemnified party for matters such as tax, product and employee liabilities. The

Company has also on occasion included intellectual property indemnification provisions in the terms of its

technology related agreements with third parties. Maximum potential future payments cannot be estimated

because many of these agreements do not have a maximum stated liability. The Company has not recorded any

liability in its consolidated financial statements for such indemnifications.

In December 2002, the FASB issued Statement of Financial Accounting Standards No. 148 (“SFAS No.

148”), Accounting for Stock-Based Compensation, Transition and Disclosure. SFAS No. 148 provides alternative

methods of transition for a voluntary change to the fair value based method of accounting for stock-based

employee compensation. SFAS No. 148 also requires that disclosures of the pro forma effect of using the fair

value method of accounting for stock-based employee compensation be displayed more prominently and in a

tabular format. Additionally, SFAS No. 148 requires disclosure of the pro forma effect in interim financial

statements. The transition and annual disclosure requirements of SFAS No. 148 are effective for fiscal years

ending after December 15, 2002. The Company adopted SFAS No. 148 effective fiscal 2003.

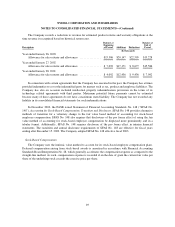

Stock-Based Compensation

The Company uses the intrinsic value method to account for its stock-based employee compensation plans.

Deferred compensation arising from stock-based awards is amortized in accordance with Financial Accounting

Standards Board Interpretation No. 28, which generally accelerates the compensation expense as compared to the

straight-line method. As such, compensation expense is recorded if on the date of grant the current fair value per

share of the underlying stock exceeds the exercise price per share.

49