NVIDIA 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

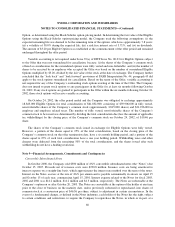

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

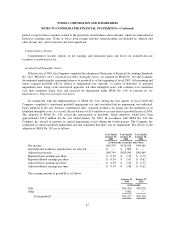

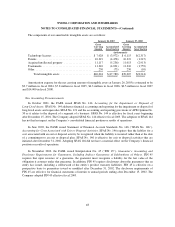

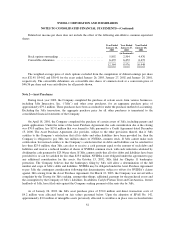

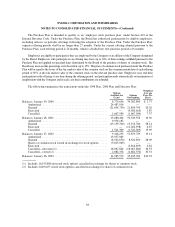

The amortized cost and estimated fair value of cash equivalents and marketable securities classified as

available-for-sale at January 26, 2003 and at January 27, 2002 by expected maturity are shown below.

January 26, 2003 January 27, 2002

Amortized

Cost

Estimated

Fair Value

Amortized

Cost

Estimated

Fair Value

(in thousands)

Less than one year ................................... $ 592,025 $ 593,714 $415,910 $415,969

Due in 1 – 5 years ................................... 424,397 428,974 382,100 382,566

Total ......................................... $1,016,422 $1,022,688 $798,010 $798,535

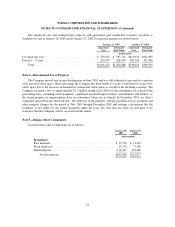

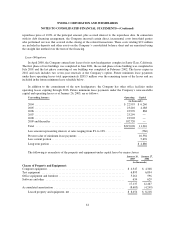

Note 4—Discontinued Use of Property

The Company moved into its new headquarters in June 2001 and was still obligated to pay rent for a portion

of its previous office space. Since relocating, the Company has been unable to secure a subtenant for its previous

office space due to the decrease in demand for commercial rental space as a result of the declining economy. The

Company recorded a loss of approximately $3.7 million during fiscal 2002 for the remaining costs related to the

preexisting lease, including rental payments, capitalized leasehold improvements, and furniture and fixtures, as

the leased property or improvements have no substantive future use or benefit. In December 2001, we filed a

complaint against Extreme Networks Inc., the sublessor of the property, seeking payment of lease payments and

other property charges for the period of July 2001 through December 2001 and seeking a declaration that the

Company is not liable for any future payments under the lease. No trial date has been set and there is no

assurance that the Company will be successful in this matter.

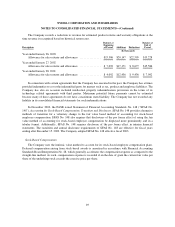

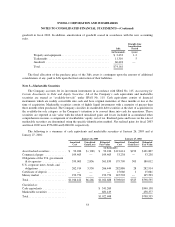

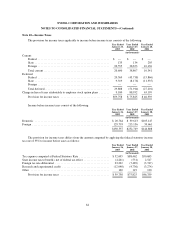

Note 5—Balance Sheet Components

Certain balance sheet components are as follows:

January 26,

2003

January 27,

2002

(in thousands)

Inventories:

Raw materials ........................................... $ 17,510 $ 13,367

Work in-process ......................................... 13,179 77,130

Finished goods .......................................... 114,357 123,380

Total inventories ..................................... $145,046 $213,877

54