NVIDIA 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

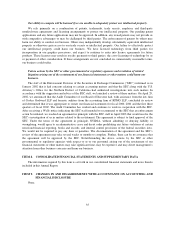

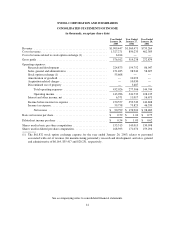

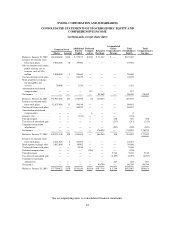

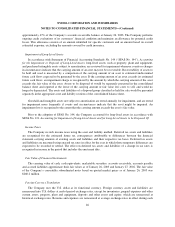

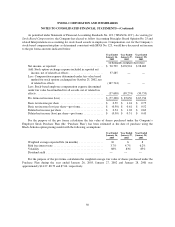

NVIDIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND

COMPREHENSIVE INCOME

(in thousands, except share data)

Common Stock

Shares Amount

Additional

Paid in

Capital

Deferred

Compen-

sation

Retained

Earnings

Accumulated

Other

Comprehensive

Income

Total

Stockholders’

Equity

Total

Comprehensive

Income

Balances, January 30, 2000 . 124,400,628 $124 $ 95,871 $(118) $ 31,547 $ — $127,424

Issuance of common stock

from stock plans ........ 9,664,606 10 19,900 — — — 19,910

Sale of common stock under

public offering, net of

issuance costs of $9.6

million ................ 2,800,000 3 96,666 — — — 96,669

Tax benefit from stock plans — — 63,199 — — — 63,199

Stock granted in exchange

for intangibles and

services ............... 50,000 — 1,324 — — — 1,324

Amortization of deferred

compensation .......... — — — 112 — — 112

Net income .............. — — — — 98,469 — 98,469 98,469

Balances, January 28, 2001 . 136,915,234 137 276,960 (6) 130,016 — 407,107

Issuance of common stock

from stock plans ........ 12,637,896 13 90,830 — — — 90,843

Tax benefit from stock plans — — 88,932 — — — 88,932

Amortization of deferred

compensation .......... — — — 6 — — 6

Issuance cost ............. — — (101) — — — (101)

Unrealized gain ........... — — — — — 528 528 528

Tax effect of unrealized gain — — — — — (213) (213) (213)

Cumulative translation

adjustments ............ — — — — — (207) (207) (207)

Net income .............. — — — — 176,924 — 176,924 176,924

Balances, January 27, 2002 . 149,553,130 150 456,621 — 306,940 108 763,819 177,032

Issuance of common stock

from stock plans ........ 4,421,823 4 25,483 — — — 25,487

Stock option exchange offer . 3,815,069 4 39,902 — — — 39,906

Tax benefit from stock plans — — 9,180 — — — 9,180

Deferred compensation ..... — — — (156) — — (156)

Unrealized gain ........... — — — — — 5,742 5,742 5,742

Tax effect of unrealized gain — — — — — (2,297) (2,297) (2,297)

Cumulative translation

adjustments ............ — — — — — 207 207 207

Net income .............. — — — — 90,799 — 90,799 90,799

Balances, January 26, 2003 . 157,790,022 $158 $531,186 $(156) $397,739 $ 3,760 $932,687 $94,451

See accompanying notes to consolidated financial statements.

42