NVIDIA 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NVIDIA CORPORATION AND SUBSIDIARIES

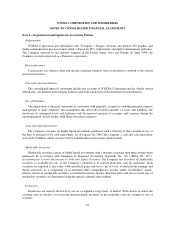

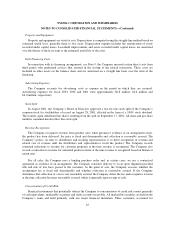

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

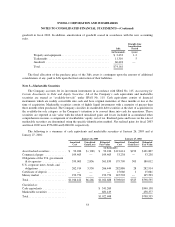

approximately 47% of the Company’s accounts receivable balance at January 26, 2003. The Company performs

ongoing credit evaluations of its customers’ financial condition and maintains an allowance for potential credit

losses. This allowance consists of an amount identified for specific customers and an amount based on overall

estimated exposure, excluding the amounts covered by credit insurance.

Impairment of Long-Lived Assets

In accordance with Statement of Financial Accounting Standards No. 144 (“SFAS No. 144”), Accounting

for the Impairment or Disposal of Long-Lived Assets, long-lived assets, such as property, plant and equipment,

and purchased intangible assets subject to amortization, are reviewed for impairment whenever events or changes

in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to

be held and used is measured by a comparison of the carrying amount of an asset to estimated undiscounted

future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated

future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset

exceeds the fair value of the asset. Assets to be disposed of would be separately presented in the consolidated

balance sheet and reported at the lower of the carrying amount or fair value less costs to sell, and would no

longer be depreciated. The assets and liabilities of a disposed group classified as held for sale would be presented

separately in the appropriate asset and liability sections of the consolidated balance sheet.

Goodwill and intangible assets not subject to amortization are tested annually for impairment, and are tested

for impairment more frequently if events and circumstances indicate that the asset might be impaired. An

impairment loss is recognized to the extent that the carrying amount exceeds the asset’s fair value.

Prior to the adoption of SFAS No. 144, the Company accounted for long-lived assets in accordance with

SFAS No. 121, Accounting for Impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed Of.

Income Taxes

The Company records income taxes using the asset and liability method. Deferred tax assets and liabilities

are recognized for the estimated future tax consequences attributable to differences between the financial

statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets

and liabilities are measured using enacted tax rates in effect for the year in which those temporary differences are

expected to be recorded or settled. The effect on deferred tax assets and liabilities of a change in tax rates is

recognized in income in the period that includes the enactment date.

Fair Value of Financial Instruments

The carrying value of cash, cash equivalents, marketable securities, accounts receivable, accounts payable

and accrued liabilities approximate their fair values as of January 26, 2003 and January 27, 2002. The fair value

of the Company’s convertible subordinated notes based on quoted market prices as of January 26, 2003 was

$260.2 million.

Foreign Currency Translation

The Company uses the U.S. dollar as its functional currency. Foreign currency assets and liabilities are

remeasured into U.S. dollars at end-of-period exchange rates, except for inventories, prepaid expenses and other

current assets, property, plant and equipment, deposits and other assets and equity, which are remeasured at

historical exchange rates. Revenue and expenses are remeasured at average exchange rates in effect during each

46