NVIDIA 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

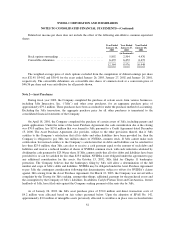

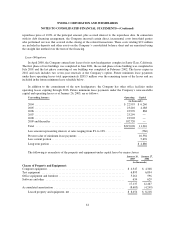

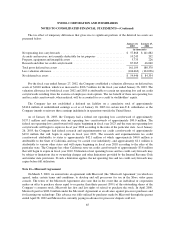

Rent expense for the years ended January 26, 2003, January 27, 2002 and January 28, 2001 was

approximately $25.6 million, $13.8 million and $3.1 million, respectively.

Litigation

On February 19, 2002 an NVIDIA stockholder, Dominic Castaldo, on behalf of himself and purportedly on

behalf of a class of Company stockholders, filed an action in the United States District Court for the Northern

District of California (the “Northern District”) against the Company and certain current and former officers of the

Company, alleging violations of the federal securities laws arising out of the Company’s announcement on

February 14, 2002 of an internal investigation of certain accounting matters. Approximately 13 similar actions

were filed in the Northern District, one additional individual action was filed in the Southern District (together,

the “Federal Class Actions”), along with three related derivative actions against the Company, certain of its

current and former executive officers, directors and its independent auditors, KPMG LLP, in California Superior

Court and in Delaware Chancery Court (collectively the “Actions”). The two related derivative actions filed in

California Superior Court have been consolidated and are currently stayed pursuant to a voluntary stipulation

agreement. The Actions allege claims in connection with various alleged statements and omissions to the public

and to the securities markets and seek damages together with interest and reimbursement of costs and expenses

of the litigation. The derivative actions also seek disgorgement of alleged profits from insider trading by officers

and directors. The Actions are in the preliminary stages. The Federal Class Actions have been consolidated and

lead plaintiffs appointed. Plaintiffs filed a consolidated amended complaint and, in response, NVIDIA filed a

motion to dismiss. On March 28, 2003 the court granted NVIDIA’s motion and dismissed the consolidated

amended complaint as to all claims and defendants with leave to amend. Plaintiffs must file their second

consolidated amended complaint by May 12, 2003. NVIDIA has also filed a motion to dismiss the derivative

action filed in Delaware. A hearing on this motion was held April 23, 2003 and a ruling is expected within the

next month. The Company is obligated to indemnify its officers and directors in connection with the Actions to

the extent permitted by the law, and has insurance for such individuals, to the extent of the limits of the

applicable insurance policies and subject to potential reservations of rights. The Company intends to vigorously

defend these Actions. The Company is unable, however, to predict the ultimate outcome of the Actions. There

can be no assurance the Company will be successful in defending the Actions, and if the Company is

unsuccessful the Company may be subject to significant damages. Even if the Company is successful, defending

the Actions is likely to be expensive and may divert management’s attention from other business concerns and

harm the Company’s business.

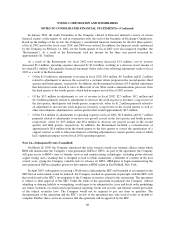

The staff of the Enforcement Division of the Securities & Exchange Commission (“SEC”) informed the

Company in January 2002 that it had concerns relating to certain accounting matters and that the SEC along with

the U.S. Attorney’s Office for the Northern District of California had authorized investigations into such matters.

In accordance with the suggestion and advice of the SEC staff, the Company launched a review of these matters.

On April 29, 2002, the Company announced that the Audit Committee of its Board of Directors had, with

assistance from the law firm of Cooley Godward LLP and forensic auditors from the accounting firm of KPMG

LLP, concluded its review and determined that it was appropriate to restate the Company’s financial statements

for fiscal 2000, 2001 and the first three quarters of fiscal 2002. The Audit Committee has worked and continues

to work in cooperation with the SEC. See Note 14 for recent developments regarding this matter.

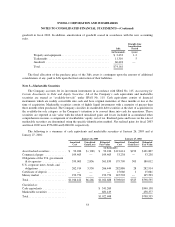

On April 18, 2001, the Company completed the purchase of certain assets of 3dfx, including patents and

patent applications. Under the terms of the Asset Purchase Agreement, the cash consideration due at the closing

was $70.0 million, less $15.0 million that was loaned to 3dfx pursuant to a Credit Agreement dated December

15, 2000. The Asset Purchase Agreement also provides, subject to the other provisions thereof, that if 3dfx

certifies to the Company’s satisfaction that all its debts and other liabilities have been provided for, then the

62