NVIDIA 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

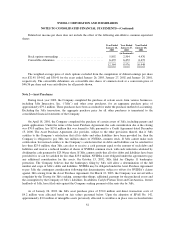

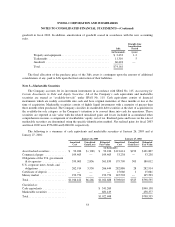

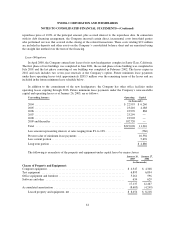

At January 26, 2003, the Company had outstanding inventory purchase obligations totaling $210.3 million.

January 26,

2003

January 27,

2002

(in thousands)

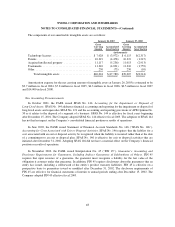

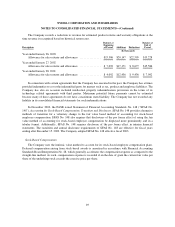

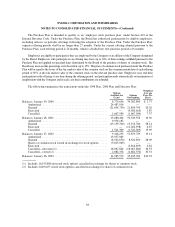

Property and Equipment:

Software ............................................... $ 48,006 $ 33,717

Test equipment .......................................... 49,961 32,330

Computer equipment ...................................... 54,479 40,169

Leasehold improvements .................................. 54,416 36,728

Construction in process .................................... 4,862 14,745

Office furniture and equipment .............................. 17,359 12,880

229,083 170,569

Accumulated depreciation and amortization ................... (93,931) (50,441)

Property and equipment, net ............................ $135,152 $120,128

Depreciation expense for fiscal 2003, 2002 and 2001 was $42.6 million, $24.3 million and $9.6 million,

respectively. Assets recorded under capital leases included in property and equipment were $17.1 million and

$12.5 million as of January 26, 2003 and January 27, 2002, respectively. Related accumulated amortization was

$8.7 million and $4.2 million as of January 26, 2003 and January 27, 2002, respectively.

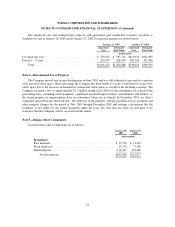

January 26,

2003

January 27,

2002

(in thousands)

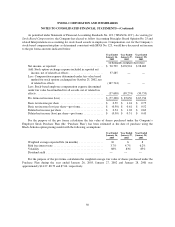

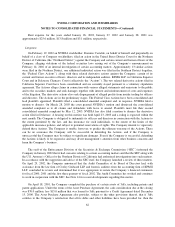

Accrued Liabilities:

Accrued customer programs ................................ $ 50,018 $ 55,627

Customer advances ....................................... 58,396 —

Taxes payable ........................................... 82,952 62,922

Accrued payroll and related expenses ........................ 20,575 16,389

Other .................................................. 16,526 6,272

Total accrued liabilities ................................ $228,467 $141,210

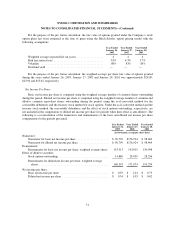

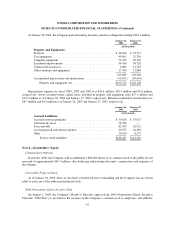

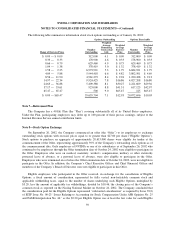

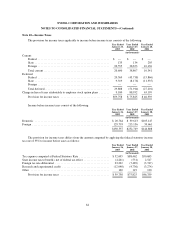

Note 6—Stockholders’ Equity

Common Stock Offering

In October 2000, the Company sold an additional 2,800,000 shares of its common stock to the public for net

proceeds of approximately $96.7 million, after deducting underwriting discounts, commissions and expenses of

the offering.

Convertible Preferred Stock

As of January 26, 2003, there are no shares of preferred stock outstanding and the Company has no current

plans to issue any of the authorized preferred stock.

2000 Nonstatutory Equity Incentive Plan

On August 1, 2000, the Company’s Board of Directors approved the 2000 Nonstatutory Equity Incentive

Plan (the “2000 Plan”) to provide for the issuance of the Company’s common stock to employees and affiliates

55