NVIDIA 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3dfx Asset Purchase

On April 18, 2001, we completed the purchase of certain assets of 3dfx, including patents and patent

applications. Under the terms of the Asset Purchase Agreement, the cash consideration due at the closing was

$70.0 million, less $15.0 million that was loaned to 3dfx pursuant to a Credit Agreement dated December 15,

2000. The Asset Purchase Agreement also provides, subject to the other provisions thereof, that if 3dfx certifies

to our satisfaction all its debts and other liabilities have been provided for, then we are obligated to pay 3dfx two

million shares of NVIDIA common stock. If 3dfx cannot make such a certification, but instead certifies to our

satisfaction that its debts and liabilities can be satisfied for less than $25.0 million, then 3dfx can elect to receive

a cash payment equal to the amount of such debts and liabilities and receive a reduced number of shares of our

common stock, with such reduction calculated by dividing the cash payment by $25.00 per share. If 3dfx cannot

certify that all of its debts and liabilities have been provided for, or can be satisfied, for less than $25.0 million,

we are not obligated under the agreement to pay any additional consideration for the assets. On October 15, 2002,

3dfx filed for Chapter 11 bankruptcy protection. We believe that the bankruptcy filing by 3dfx will allow a

determination of the full number and scope of 3dfx’s debts and liabilities. NVIDIA may be obligated under the

Asset Purchase Agreement to pay 3dfx the contingent consideration following this determination, subject to

offsets for NVIDIA’s claims against 3dfx arising from the Asset Purchase Agreement. On March 12, 2003, we

were served with a complaint by the Trustee for 3dfx seeking, among other things, additional payment for the

purchased assets and the assumption by us of 3dfx’s liabilities. In addition, Carlyle Fortran Trust and

CarrAmerica, former landlords of 3dfx, have filed suits against us seeking payment of the rents due by 3dfx.

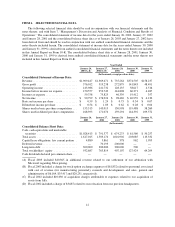

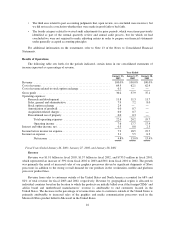

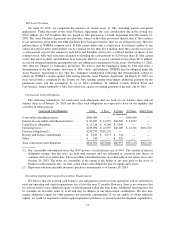

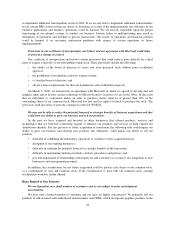

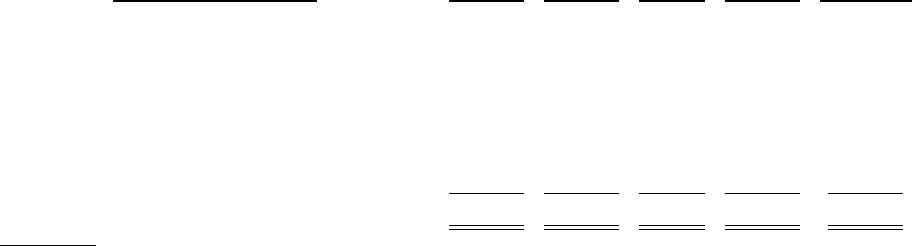

Contractual Cash Obligations

The following summarizes our contractual cash obligations that are both on our balance sheet and off

balance sheet as of January 26, 2003 and the effect such obligations are expected to have on our liquidity and

cash flow in future periods:

Contractual Cash Obligations Total 1 Year 2-3 Years 4-5 Years After 5 Years

(in thousands)

Convertible subordinated notes ................. $300,000 — — $300,000 —

Interest on convertible subordinated notes(1) ...... $ 67,687 $ 14,250 $28,500 $ 24,937 —

Capital lease obligations ....................... $ 11,316 $ 6,260 $ 5,056 — —

Operating leases ............................. $219,096 $ 22,995 $46,180 $ 47,201 $102,720

Purchase obligations(2) ....................... $210,270 $210,270 — — —

Royalty and license commitments ............... $ 2,612 $ 1,871 $ 741 — —

Other ...................................... $ 520 — $ 520 — —

Total contractual cash obligations ............... $811,501 $255,646 $80,997 $372,138 $102,720

(1) Our convertible subordinated notes due 2007 possess a fixed interest rate of 4¾%. The amount of interest

obligation assumes that the notes are held until maturity and not redeemed or converted into shares of

common stock at an earlier date. The convertible subordinated notes are redeemable at our option on or after

October 20, 2003. The notes are convertible at the option of the holder at any time prior to the close of

business on the maturity date. As such, actual future cash obligations may be significantly lower.

(2) Represents our noncancelable inventory purchase commitments as of January 26, 2003.

Operating Capital and Capital Expenditure Requirements

We believe that our existing cash balances and anticipated cash flows from operations will be sufficient to

meet our operating and capital requirements for at least the next 12 months. However, there is no assurance that

we will not need to raise additional equity or debt financing within this time frame. Additional financing may not

be available on favorable terms or at all and may be dilutive to our then-current stockholders. We also may

require additional capital for other purposes not presently contemplated. If we are unable to obtain sufficient

capital, we could be required to curtail capital equipment purchases or research and development expenditures,

21