NVIDIA 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

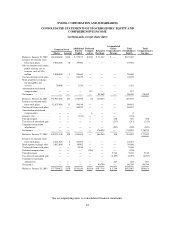

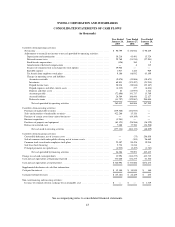

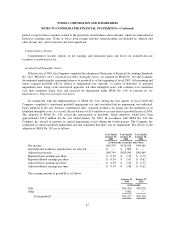

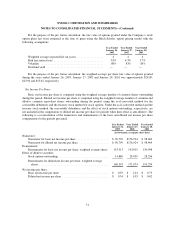

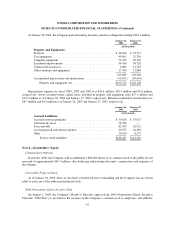

The components of our amortizable intangible assets are as follows:

January 26, 2003 January 27, 2002

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

(in thousands)

Technology licenses ........................... $ 7,028 $ (3,972) $ 6,115 $(2,317)

Patents ...................................... 10,319 (4,478) 10,319 (1,215)

Acquired intellectual property ................... 11,117 (5,236) 11,013 (2,913)

Trademarks .................................. 11,310 (4,021) 11,310 (1,759)

Other ....................................... 250 (73) 250 (10)

Total intangible assets ..................... $40,024 $(17,780) $39,007 $(8,214)

Amortization expense for the net carrying amount of intangible assets at January 26, 2003 is estimated to be

$9.7 million in fiscal 2004, $7.8 million in fiscal 2005, $4.3 million in fiscal 2006, $0.5 million in fiscal 2007

and $14,000 in fiscal 2008.

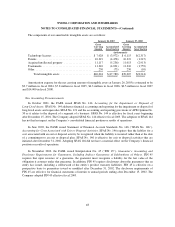

New Accounting Pronouncements

In October 2001, the FASB issued SFAS No. 144, Accounting for the Impairment or Disposal of

Long-Lived Assets. SFAS No. 144 addresses financial accounting and reporting for the impairment or disposal of

long-lived assets and supercedes SFAS No. 121 and the accounting and reporting provisions of APB Opinion No.

30 as it relates to the disposal of a segment of a business. SFAS No. 144 is effective for fiscal years beginning

after December 15, 2001. The Company adopted SFAS No. 144 effective fiscal 2003. The adoption of SFAS 144

has not had an impact on the Company’s consolidated financial position or results of operations.

In June 2002, the FASB issued Statement of Financial Account Standards No. 146 (“SFAS No. 146”),

Accounting for Costs Associated with Exit or Disposal Activities. SFAS No. 146 requires that the liability for a

cost associated with an exit or disposal activity be recognized when the liability is incurred rather than at the date

of a commitment to an exit or disposal plan. SFAS No. 146 is effective for exit or disposal activities that are

initiated after December 31, 2002. Adopting SFAS 146 did not have a material effect on the Company’s financial

position or results of operations.

In November 2002, the FASB issued Interpretation No. 45 (“FIN 45”), Guarantor’s Accounting and

Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others. FIN 45

requires that upon issuance of a guarantee, the guarantor must recognize a liability for the fair value of the

obligation it assumes under that guarantee. In addition, FIN 45 requires disclosures about the guarantees that an

entity has issued, including a rollforward of the entity’s product warranty liabilities. FIN 45 is effective on a

prospective basis to guarantees issued or modified after December 31, 2002. The disclosure requirements of

FIN 45 are effective for financial statements of interim or annual periods ending after December 15, 2002. The

Company adopted FIN 45 effective fiscal 2003.

48