NVIDIA 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

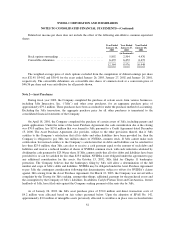

repurchase price of 100% of the principal amount, plus accrued interest to the repurchase date. In connection

with its debt financing arrangement, the Company incurred certain direct, incremental costs from third parties

who performed services that assisted in the closing of the related transactions. These costs totaling $9.2 million

are included in deposits and other assets on the Company’s consolidated balance sheet and are amortized using

the straight line method over the term of the financing.

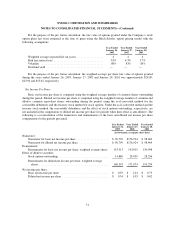

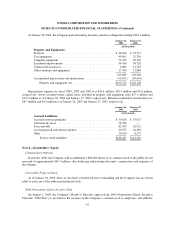

Lease Obligations

In April 2000, the Company entered into leases for its new headquarters complex in Santa Clara, California.

The first phase of two buildings was completed in June 2001, the second phase of one building was completed in

July 2001 and the last phase consisting of one building was completed in February 2002. The leases expire in

2012 and each includes two seven-year renewals at the Company’s option. Future minimum lease payments

under these operating leases total approximately $205.5 million over the remaining terms of the leases and are

included in the future minimum lease schedule below.

In addition to the commitment of the new headquarters, the Company has other office facilities under

operating leases expiring through 2016. Future minimum lease payments under the Company’s noncancelable

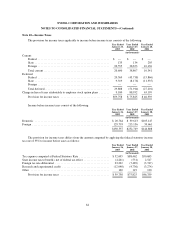

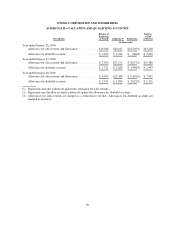

capital and operating leases as of January 26, 2003, are as follows:

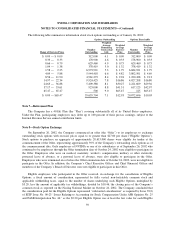

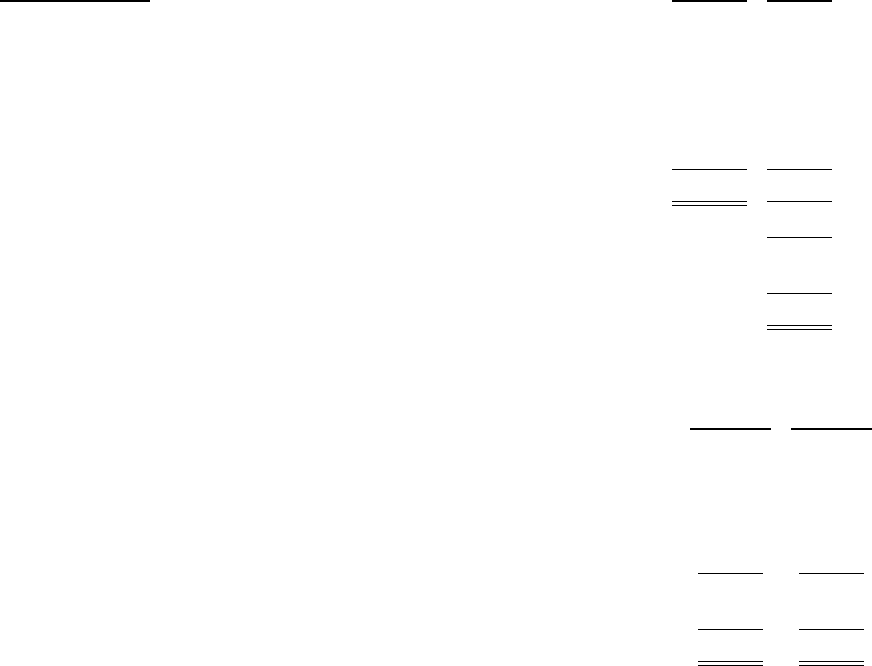

Year ending January: Operating Capital

(in thousands)

2004 ............................................................. $ 22,995 $ 6,260

2005 ............................................................. 23,210 4,188

2006 ............................................................. 22,970 868

2007 ............................................................. 23,299 —

2008 ............................................................. 23,902 —

2009 and thereafter ................................................. 102,720 —

Total ............................................................ $219,096 11,316

Less amount representing interest, at rates ranging from 8% to 10% ........... (760)

Present value of minimum lease payments ............................... 10,556

Less current portion ................................................. 5,676

Long term portion .................................................. $ 4,880

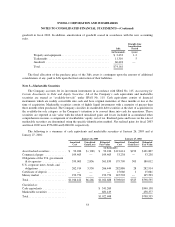

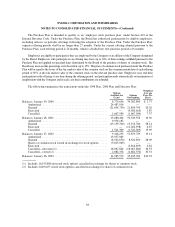

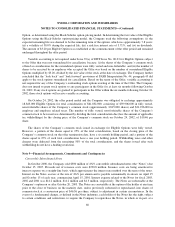

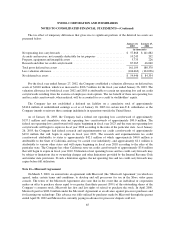

The following is an analysis of the property and equipment under capital leases by major classes:

January 26,

2003

January 27,

2002

(in thousands)

Classes of Property and Equipment:

Computer equipment ...................................................... $ 4,347 $ 4,348

Test equipment .......................................................... 6,895 6,894

Office equipment and furniture .............................................. 5,261 596

Software and other ....................................................... 634 629

17,137 12,467

Accumulated amortization ................................................. (8,683) (4,249)

Leased property and equipment, net ...................................... $ 8,454 $ 8,218

61