NVIDIA 2003 Annual Report Download - page 24

Download and view the complete annual report

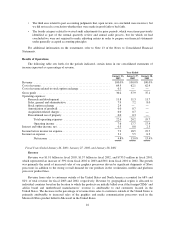

Please find page 24 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.which could harm our business. Factors that could affect our cash used or generated from operations and, as a

result, our need to seek additional borrowings or capital include:

• decreased demand and market acceptance for our products and/or our customers’ products;

• inability to successfully develop and produce in volume production our next-generation products;

• competitive pressures resulting in lower than expected average selling prices; and

• new product announcements or product introductions by our competitors.

For additional factors see “Business Risks—Our operating results are unpredictable and may fluctuate, and

if our operating results are below the expectations of securities analysts or investors, our stock price could

decline.”

Other Information

Consistent with Section 10A(i)(2) of the Securities Exchange Act of 1934, as added by Section 202 of the

Public Company Accounting Reform and Investor Protection Act of 2002, NVIDIA is responsible for disclosing

the nature of the non-audit services approved by our Audit Committee during a quarter to be performed by

KPMG LLP, our independent auditor. Non-audit services are services other than those provided by KPMG LLP

in connection with an audit or a review of NVIDIA’s financial statements. During the fourth quarter of fiscal year

2003, our Audit Committee did approve new and recurring engagements performed by KPMG LLP for the

following non-audit services (1) income tax, transactional tax and payroll tax return preparation, (2) general tax

consultation and advice, (3) international statutory audits, and (4) consultation regarding accounting standards

and issues.

Recent Accounting Pronouncements

Information regarding recent accounting pronouncements is set forth in Note 1 of the Notes to Consolidated

Financial Statements under the subheading “New Accounting Pronouncements,” which information is hereby

incorporated by reference.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate Risk

We invest in a variety of financial instruments, consisting principally of investments in commercial paper,

money market funds and highly liquid debt securities of corporations, municipalities and the U.S. Government

and its agencies. These investments are denominated in U.S. dollars.

We account for our investment instruments in accordance with Statement of Financial Accounting Standards

No. 115 (“SFAS No. 115”), Accounting for Certain Investments in Debt and Equity Securities. All of the cash

equivalents and marketable securities are treated as “available-for-sale” under SFAS No. 115. Investments in

both fixed rate and floating rate interest earning instruments carry a degree of interest rate risk. Fixed rate

securities may have their market value adversely impacted due to a rise in interest rates, while floating rate

securities may produce less income than expected if interest rates fall. Due in part to these factors, our future

investment income may fall short of expectations due to changes in interest rates or we may suffer losses in

principal if forced to sell securities that decline in market value due to changes in interest rates. However,

because our debt securities are classified as “available-for-sale”, no gains or losses are recognized due to changes

in interest rates unless such securities are sold prior to maturity. These securities are reported at fair value with

the related unrealized gains and losses included in accumulated other comprehensive income, a component of

stockholders’ equity, net of tax. As of January 26, 2003, a sensitivity analysis was performed on our floating and

fixed rate financial investments. Parallel shifts in the yield curve of both +/-50 basis points would result in

changes in fair market values for these investments of approximately $3.5 million.

Our convertible subordinated notes due 2007 possess a fixed interest rate of 4¾% and are not subject to

interest rate fluctuations.

22