NVIDIA 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our ability to compete will be harmed if we are unable to adequately protect our intellectual property.

We rely primarily on a combination of patents, trademarks, trade secrets, employee and third-party

nondisclosure agreements and licensing arrangements to protect our intellectual property. Our pending patent

applications and any future applications may not be approved. In addition, any issued patents may not provide us

with competitive advantages or may be challenged by third parties. The enforcement of patents by others may

harm our ability to conduct our business. Others may independently develop substantially equivalent intellectual

property or otherwise gain access to our trade secrets or intellectual property. Our failure to effectively protect

our intellectual property could harm our business. We have licensed technology from third parties for

incorporation in our graphics processors, and expect to continue to enter into license agreements for future

products. These licenses may result in royalty payments to third parties, the cross-licensing of technology by us

or payment of other consideration. If these arrangements are not concluded on commercially reasonable terms,

our business could suffer.

Future actions by the SEC or other governmental or regulatory agencies and resolution of related

litigation arising out of the restatement of our financial statements or other matters could harm our

business.

The staff of the Enforcement Division of the Securities & Exchange Commission (“SEC”) informed us in

January 2002 that it had concerns relating to certain accounting matters and that the SEC along with the U.S.

Attorney’s Office for the Northern District of California had authorized investigations into such matters. In

accordance with the suggestion and advice of the SEC staff, we launched a review of these matters. On April 29,

2002, we announced that the Audit Committee of our Board of Directors had, with assistance from the law firm

of Cooley Godward LLP and forensic auditors from the accounting firm of KPMG LLP, concluded its review

and determined that it was appropriate to restate our financial statements for fiscal 2000, 2001 and the first three

quarters of fiscal 2002. The Audit Committee has worked and continues to work in cooperation with the SEC.

After receiving a Wells notice indicating the SEC staff intended to recommend to the SEC that an enforcement

action be initiated, we reached an agreement in principle with the SEC staff in April 2003 that would resolve the

SEC’s investigation of us in matters related to the restatement. The agreement is subject to final approval of the

SEC. Under the terms of the agreement in principle, NVIDIA, without admitting or denying liability or

wrongdoing, would agree to an administrative cease and desist order prohibiting any future violations of certain

non-fraud financial reporting, books and records, and internal control provisions of the federal securities laws.

We would not be required to pay any fines or penalties. The documentation of the agreement and the SEC’s

review of the agreement may take several weeks or months to complete. Further, there can be no assurance that

the agreement will be approved by the SEC. Notwithstanding the above, actions by the SEC or other

governmental or regulatory agencies with respect to us or our personnel arising out of the restatement of our

financial statements or other matters may take significant time, may be expensive and may divert management’s

attention from other business concerns and harm our business.

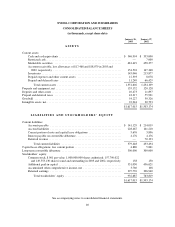

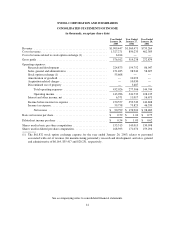

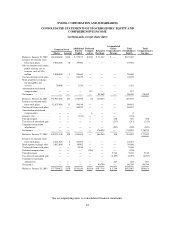

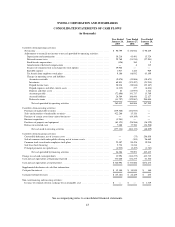

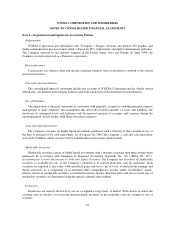

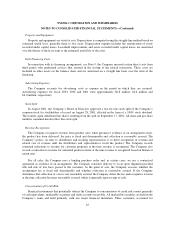

ITEM 8. CONSOLIDATED FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The information required by this item is set forth in our consolidated financial statements and notes thereto

included in this Annual Report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

35