NVIDIA 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

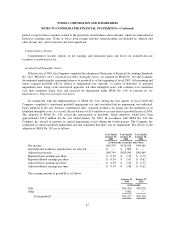

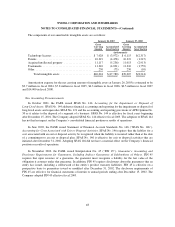

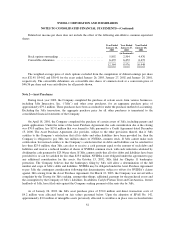

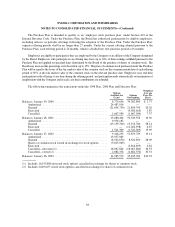

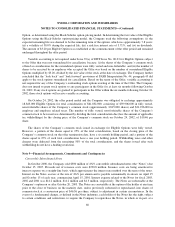

As permitted under Statement of Financial Accounting Standards No. 123 (“SFAS No.123”), Accounting for

Stock-Based Compensation, the Company has elected to follow Accounting Principles Board Opinion No. 25 and

related Interpretations in accounting for stock-based awards to employees. Compensation cost for the Company’s

stock-based compensation plans as determined consistent with SFAS No. 123, would have decreased net income

to the pro forma amounts indicated below:

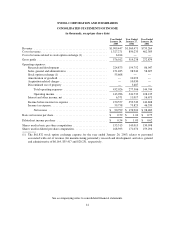

Year Ended

January 26,

2003

Year Ended

January 27,

2002

Year Ended

January 28,

2001

(in thousands, except per share data)

Net income, as reported ................................. $ 90,799 $176,924 $ 98,469

Add: Stock option exchange expense included in reported net

income, net of related tax effects ........................ 37,285 — —

Less: Compensation expense determined under fair value based

method for stock options exchanged on October 25, 2002, net

of related tax effects (167,714) — —

Less: Stock-based employee compensation expense determined

under fair value based method for all awards, net of related tax

effects ............................................... (37,698) (89,274) (30,735)

Pro forma net income (loss) .............................. $ (77,328) $ 87,650 $ 67,734

Basic net income per share .............................. $ 0.59 $ 1.24 $ 0.75

Basic net income (loss) per share—pro forma ................ $ (0.50) $ 0.61 $ 0.52

Diluted net income per share ............................. $ 0.54 $ 1.03 $ 0.62

Diluted net income (loss) per share—pro forma .............. $ (0.50) $ 0.51 $ 0.43

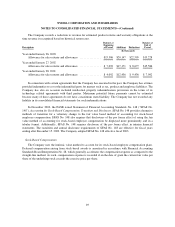

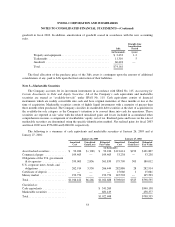

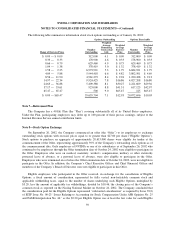

For the purpose of the pro forma calculation the fair value of shares purchased under the Company’s

Employee Stock Purchase Plan (the “Purchase Plan”) has been estimated at the date of purchase using the

Black-Scholes option pricing model with the following assumptions:

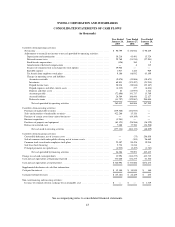

Year Ended

January 26,

2003

Year Ended

January 27,

2002

Year Ended

January 28,

2001

Weighted average expected life (in months) ................. 10 6 8

Risk free interest rate ................................... 3.7% 4.7% 6.2%

Volatility ............................................ 88% 83% 85%

Dividend yield ........................................ — — —

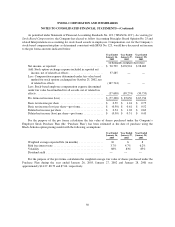

For the purpose of the pro forma calculation the weighted-average fair value of shares purchased under the

Purchase Plan during the year ended January 26, 2003, January 27, 2002 and January 28, 2001 was

approximately $14.27, $8.79 and $7.04, respectively.

50