JVC 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Victor Company of Japan, Limited

50 Annual Report 2003

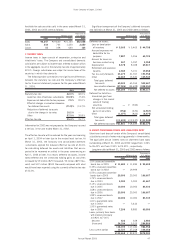

As the company applied hedge accounting to all derivatives

in 2002, market value information for 2002 is not disclosed.

Thousands of U.S. dollars

Contract Market Recognized

March 31, 2003 amount value gain (loss)

Swap contracts:

Receive floating/pay fixed $66,775 $(4,417) $(4,417)

The fair value of interest swap contracts is estimated based

on the quotes obtained from financial institutions.

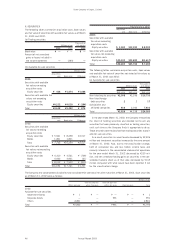

14. LEASE INFORMATION

The Company leases certain buildings and structures, vehicles,

machinery and equipment and other assets under non-capital-

ized finance and operating leases. Finance leases which do not

transfer ownership to lessees are not capitalized and are ac-

counted for in the same manner as operating leases. Certain

information for such non-capitalized finance and operating leases

is as follows.

Lessee:

(1) A summary of assumed amounts of acquisition cost, accu-

mulated depreciation and net book value at March 31, 2003

and 2002 is as follows:

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

2003:

Buildings and structures ¥ 1,505 ¥ 687 ¥ 818

Vehicles, machinery and

equipment 7,315 3,621 3,694

Tools, furniture and fixtures 10,922 5,282 5,640

Leasehold rights 399 219 180

Software 128 51 77

¥20,269 ¥9,860 ¥10,409

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

2002:

Buildings and structures ¥ 1,223 ¥ 446 ¥ 777

Vehicles, machinery and

equipment 7,882 3,688 4,194

Tools, furniture and fixtures 12,575 6,221 6,354

Leasehold rights 183 79 104

Software 56 27 29

¥21,919 ¥10,461 ¥11,458

Thousands of U.S. dollars

Acquisition Accumulated Net book

cost depreciation value

2003:

Buildings and structures $ 12,542 $ 5,725 $ 6,817

Vehicles, machinery and

equipment 60,958 30,175 30,783

Tools, furniture and fixtures 91,017 44,017 47,000

Leasehold rights 3,325 1,825 1,500

Software 1,067 425 642

$168,909 $82,167 $86,742

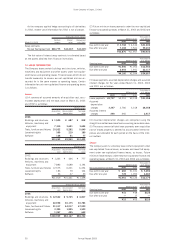

(2) Future minimum lease payments under the non-capitalized

finance and operating leases at March 31, 2003 and 2002 are

as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Due within one year ¥ 3,768 ¥ 4,346 $31,400

Due after one year 7,108 7,561 59,233

¥10,876 ¥11,907 $90,633

Thousands of

Millions of yen U.S. dollars

Operating leases 2003 2002 2003

Due within one year ¥1,506 ¥1,053 $12,550

Due after one year 2,654 1,941 22,117

¥4,160 ¥2,994 $34,667

(3) Lease payments, assumed depreciation charges and assumed

interest charges for the years ended March 31, 2003, 2002

and 2001 are as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2001 2003

Lease payments ¥3,727 ¥4,253 ¥3,018 $31,058

Assumed

depreciation

charges 3,367 3,780 3,018 28,058

Assumed interest

charges 290 466 — 2,417

(4) Assumed depreciation charges are computed using the

straight-line method over lease terms assuming no residual value.

(5) The excess amount of total lease payments over acquisition

cost of leased property is deemed as accumulated interest ex-

penses and allocated for each period on the basis of the inter-

est method.

Lessor:

The Company and its subsidiary lease certain equipment under

non-capitalized finance leases, as lessees and lease that equip-

ment under non-capitalized finance leases, as lessors. Future

minimum lease receipts under these non-capitalized finance and

operating leases at March 31, 2003 and 2002 are as follows:

Thousands of

Millions of yen U.S. dollars

Non-capitalized finance leases 2003 2002 2003

Due within one year ¥ 683 ¥1,031 $ 5,692

Due after one year 778 1,093 6,483

¥1,461 ¥2,124 $12,175

Thousands of

Millions of yen U.S. dollars

Operating leases 2003 2002 2003

Due within one year ¥15 ¥38 $125

Due after one year —17 —

¥15 ¥55 $125