JVC 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Victor Company of Japan, Limited

Annual Report 2003 35

Other

Sales dropped 17.7%, or ¥1.4 billion,

to ¥6.5 billion, while operating in-

come grew ¥1.7 billion, to ¥1.2 bil-

lion, reversing the previous year’s

operating loss.

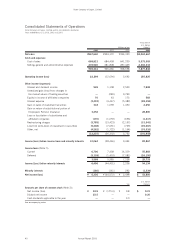

Income (Loss) Before Income Taxes

and Minority Interests

Income before income taxes and mi-

nority interests grew ¥48.5 billion year

on year, to ¥10.1 billion, due to the

turnaround in operating income and

lower restructuring charges.

Income Taxes

Income taxes fell 40.4%, or ¥2.4 bil-

lion, to ¥3.6 billion. This represented

an effective tax rate of 35.5%.

Net Income (Loss)

Net income was ¥6.3 billion, a ¥50.9

billion improvement from fiscal 2002’s

net loss. Consequently, the company

reversed the net loss per share of

¥175.3 in the previous fiscal year to

post net income per share of ¥24.9.

ROE also rose from negative 27.3% to

4.3% in the year under review. Despite

this improved performance, the com-

pany made the difficult decision not

to pay a dividend for fiscal 2003.

Components & Devices

Healthy sales of motors for electronic

devices could not cancel out the impact

of the protracted slump in the IT sector,

which continued to depress demand for

high-density build-up multilayer printed

wiring boards (“VIL” PWBs) and deflec-

tion yokes. As a result, this segment

posted a 4.2%, or ¥2.1 billion, decline

in sales, to ¥47.6 billion, and an oper-

ating loss of ¥0.7 billion.

Software & Media

Sales in this segment declined 5.4%,

or ¥9.5 billion, to ¥167.5 billion, while

operating income fell ¥1.9 billion, to

¥1.3 billion. Sales fell due to the

industry-wide downturn in software and

the effects of delays in the launch of

music content. The decline was checked

by higher sales of software and media

consigned from other companies.