JVC 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Victor Company of Japan, Limited

48 Annual Report 2003

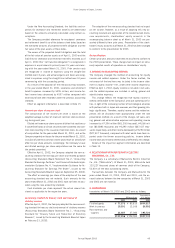

The 1.5% unsecured convertible bonds are redeemable prior

to their stated maturity, in whole or in part, at the option of the

Company at prices ranging from 107% to 100% of the princi-

pal amount. The price at which shares of common stock shall

be issued upon conversion is ¥2,867 ($23.89) per share, sub-

ject to adjustment under certain circumstances. The 0.55%

unsecured convertible bonds are redeemable prior to their stated

maturity, in whole or in part, at the option of the Company at

prices ranging from 103% to 100% of the principal amount.

The price at which shares of common stock shall be issued upon

conversion is ¥1,487 ($12.39) per share, subject to adjustment

under certain circumstances.

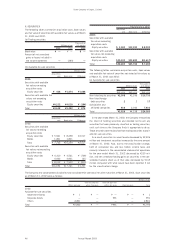

The aggregate annual maturities of long-term debt at March

31, 2003 were as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2004 ¥ 12,727 $106,058

2005 17,498 145,817

2006 57,337 477,808

2007 20,134 167,783

2008 10,136 84,467

Thereafter 363 3,025

¥118,195 $984,958

9. PLEDGED ASSETS

The following assets were pledged as collateral for long-term

debt, including current portion, at March 31, 2003:

Thousands of

Millions of yen U.S. dollars

Buildings 467 3,892

Land 180 1,500

¥647 $5,392

10. EMPLOYEES’ SEVERANCE AND RETIREMENT BENEFITS

As explained in Note 2, Significant Accounting Policies, effec-

tive April 1, 2000, the Companies adopted the new accounting

standard (“Opinion on Setting Accounting Standard for Employ-

ees’ Severance and Retirement Benefits”).

(Return of substitutional portion of Employees’ Pension

Insurance)

Employees of Japanese companies are compulsorily included

in the Welfare Pension Insurance Scheme operated by the gov-

ernment. Employers are legally required to deduct employees’

welfare pension insurance contributions from their payroll and

to pay them to the government together with employers’ own

contributions. For companies that have established their own

Employees’ Pension Fund which meets certain legal requirements,

it is possible to transfer a part of their welfare pension insurance

contributions (referred to as the substitutional portion of the

government’s scheme) to their own Employees’ Pension Fund

under the government’s permission and supervision.

Based on the newly enacted Defined Benefit Corporate Pen-

sion Law, the Company and its domestic consolidated subsid-

iaries decided to restructure their Employees’ Pension Fund and

were permitted by the Minister of Health, Labor and Welfare on

July 1, 2002 to be released from their future obligation for pay-

ments for the substitutional portion of the Welfare Pension In-

surance Scheme. Pension assets for the substitutional portion

maintained by the Employees’ Pension Fund are to be trans-

ferred back to the government.

The Company and its domestic consolidated subsidiaries

applied the transitional provisions as prescribed in paragraph

47-2 of the JICPA Accounting Committee Report No. 13, “Prac-

tical Guideline for Accounting of Retirement Benefits (Interim

Report)”, and the effect of transferring the substitutional portion

was recognized on the date permission was received from the

Ministry of Health, Labor and Welfare. As a result, in the year

ended March 31, 2003, the Company and its consolidated do-

mestic subsidiaries recorded gains on the release from the sub-

stitutional portion of the government’s Welfare Pension Insurance

Scheme amounting to ¥3,456 million ($28,800 thousand),

which was calculated based on the amounts of the substitu-

tional portion of the projected benefit obligations, the related

pension assets, and the related unrecognized items.

The amount of pension plan assets expected to be transferred

back to the government approximated ¥65,305 million

($544,208 thousand) as at March 31, 2003.

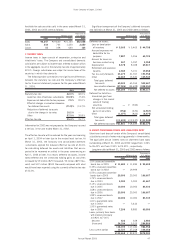

Liability for employees’ retirement benefits included in liabilities in the consolidated balance sheets for 2003 and 2002 and the

related expenses for 2003, 2002 and 2001, which were determined based on the amounts obtained by actuarial calculations, were

as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Projected benefit obligation:

Projected benefit obligation ¥(164,185) ¥(252,417) $(1,368,208)

Unamortized prior service costs —(8,009) —

Unamortized actuarial differences 55,865 42,321 465,542

Less fair value of pension assets 75,037 159,425 625,308

Less unrecognized net transition obligation 19,225 36,129 160,208

Liability for severance and retirement benefits (14,058) (22,551) (117,150)