JVC 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Victor Company of Japan, Limited

46 Annual Report 2003

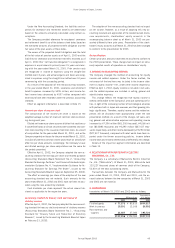

6. SECURITIES

The following tables summarize acquisition costs, book values

and fair value of securities with available fair values as of March

31, 2003 and 2002:

(a) Trading securities

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Book value ¥ — ¥ — $ —

Amount of net unrealized

gains or losses included in

the income statement —(280) —

(b) Available-for-sale securities

Millions of yen

Acquisition

cost Book value Difference

2003:

Securities with available

fair values exceeding

acquisition costs

Equity securities ¥ 406 ¥1,474 ¥1,068

Securities with available fair

values not exceeding

acquisition costs

Equity securities ¥4,212 ¥4,018 ¥ (194)

Total ¥4,618 ¥5,492 ¥ 874

Millions of yen

Acquisition

cost Book value Difference

2002:

Securities with available

fair values exceeding

acquisition costs

Equity securities ¥ 5,941 ¥ 8,458 ¥2,517

Bonds 1,801 1,801 —

Total ¥ 7,742 ¥10,259 ¥2,517

Securities with available

fair values not exceeding

acquisition costs

Equity securities ¥ 4,310 ¥ 3,561 ¥ (749)

Bonds 4,002 3,941 (61)

Total ¥ 8,312 ¥ 7,502 ¥ (810)

Total ¥16,054 ¥17,761 ¥1,707

Thousands of U.S. dollars

Acquisition

cost Book value Difference

2003:

Securities with available

fair values exceeding

acquisition costs

Equity securities $ 3,383 $12,283 $ 8,900

Securities with available

fair values not exceeding

acquisition costs

Equity securities $35,100 $33,483 $(1,617)

Total $38,483 $45,766 $ 7,283

The following tables summarize acquisition costs, book values

and available fair value of securities not stated at fair values as

of March 31, 2003 and 2002:

(a) Available-for-sale securities

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Book value Book value Book value

Non-listed equity securities ¥2,008 ¥2,196 $16,733

Non-listed foreign

debt securities 2217

Subsidiaries and

affiliated companies 916 2,040 7,633

Total ¥2,926 ¥4,238 $24,383

In the year ended March 31, 2002, the Company re-examined

the intent of holding securities and decided not to sell any

securities that were previously classified as trading securities,

until such time as the Company finds it appropriate to do so.

Those securities were reclassified from trading securities to avail-

able-for-sale securities.

As a result, securities in current assets decreased by ¥2,426

million and investment securities increased by the same amount

at March 31, 2002. Also, due to the classification change,

both of unrealized loss and loss before income taxes and

minority interests in the consolidated statement of operations

for the year ended March 31, 2002 decreased by ¥230 mil-

lion, and net unrealized holding gains on securities in the con-

solidated balance sheet as of that date decreased by ¥145

million compared with what would have been reported if not

for the classification change.

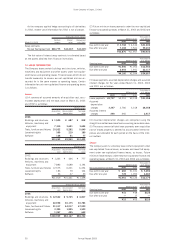

The Company and consolidated subsidiaries had no available-for-sale securities with maturities at March 31, 2003. Such securities

as of March 31, 2002 were as follows:

Millions of yen

Over one year but Over five years but

Within one year within five years within ten years Over ten years Total

2002:

Available-for-sale securities

Government bonds ¥ 1 ¥ — ¥ — ¥ — ¥ 1

Corporate bonds — — 991 — 991

Others 2,801 — — — 2,801

Total ¥2,802 ¥ — ¥991 ¥ — ¥3,793