JVC 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Victor Company of Japan, Limited

26 Annual Report 2003

Software & Media

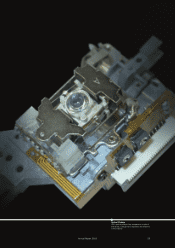

D-VHS Tapes

The digital version of the de facto VHS standard

invented by JVC

Mini-DV Tapes

Highly functional digital cassette tape using

technology unique to JVC

Mini-DV Digital Hi-Vision Tapes

Realizing high-definition recordings on

Mini-DV tape

Hiroshi Fujisawa

President, Media Company

camcorder market share and we make

further technological advances in the

DVC format. We also started develop-

ing new media for technologies such

as Blu-ray Discs and advanced optical

discs. Sales in the next year or two will

depend on the market acceptance rate

for related hardware devices.

In recorded media, we make the

most of our powerful value chain in the

content business, applying our exclu-

sive Digital K2 audio technology from

the mastering stage onward to deliver

sound quality incredibly close to the

orginal. We also quickly adapt technol-

ogy and distribution techniques to

changes in customer needs.

Structural Reform and Cost

Reduction Benefits

Falling sales prices for recordable

media and recorded media exert in-

creasing pressure on profit margins.

Survival requires a constant search for

further cost savings. During the past

fiscal year, we took a number of steps,

including closing a U.S. disc factory

to consolidate all disc production at a

single location, and initiating employ-

ment structure reform. At media

MEDIA BUSINESS

Renewed Focus on Core Strengths

and Growth Strategies

Our main media business activity is

manufacturing and selling blank record-

able media and recorded media on CD,

DVD and tape formats. Recorded media

contgent includes material owned by

JVC as well as material acquired through

deals with content partners.

Our DVD-RW discs have earned a

reputation for reliability in Japan and

overseas, thanks to their extremely low

error rate during playback and record-

ing. In Japan, we have a market share

of about 60% on a shipment basis. To

cement our DVD products as the de

facto standard in the domestic market,

we are now investing in additional

capacity that will raise monthly DVD

output from the past fiscal year’s

450,000 units to one million units

this year. Mini-DV tape is another im-

portant product in this business. This

tape, a global product, is currently the

only cost-efficient media capable of

high-definition recording and play-

back. We expect growth in demand for

this tape as our digital video cameras

capture a growing share of the

factories, we reduced the level of de-

fects and established a highly flexible

manufacturing system. For example, we

now produce small volumes of recorded

media at a profit, which is certain to

lead to higher earnings. In audiotape,

a market with a dwindling number of

players, we cut costs to the point where

we benefit as one of the few remaining

manufacturers.

The emergence of new forms of

media offering even higher recording

speeds and densities presents numer-

ous opportunities for JVC’s media

business. Having completed the

groundwork to capitalize on these

trends, we now look forward to using

these new technologies to generate

higher sales and earnings.

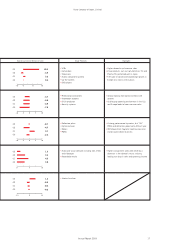

With expertise in areas from artist development to the manufacture and sale of recorded media, this segment boasts a

complete and integrated value chain. The media business mainly manufactures and sells recordable media and prerecorded

software such as CDs and DVDs. The software business primarily identifies and develops promising artists, and also pro-

duces, distributes and sells content. The Software & Media segment accounted for 17% of total fiscal 2003 sales. Weak-

ness in Japan’s market for music CDs caused segment sales to decline 5% and dragged operating income down by 59%

during the year under review.

In the software business, JVC withdrew from the movie business and divested its game business to improve profitability.

We are now concentrating this business on music content to boost earnings.