JVC 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Victor Company of Japan, Limited

18 Annual Report 2003

The consumer electronics segment derives the majority of its earnings from the development, manufacture and sale of audio

and visual products. Products in this segment account for about 70% of total sales. Overseas markets account for more than

80% of segment sales, reflecting the popularity of JVC products outside Japan. Consumer electronics performed well in fiscal

2003, achieving an operating margin of 3.7% and making a significant contribution to JVC’s return to profitability.

D-VHS High-Definition Digital Video Recorders

The world’s first high-definition video recorder for

the consumer market

Consumer Electronics

DVD Recorders

Superior picture quality and multi-format

recording and playback capabilities

Plasma TVs (PDPs)

Incorporating unique JVC DIST/DET technology to

realize high-resolution picture quality by making

scanning lines almost invisible

Business Segment Overview

Competing Against Time in Multiple

Geographies

An October 2002 reorganization gave

the consumer electronics segment an

operating structure based on product

category, with eight separate manage-

ment units for each product category.

Our previous system had centered on

two business units, each responsible

for a number of audio or video prod-

uct categories. This new system means

we can conduct all development,

manufacturing and sales for each

product within each of these new

units, allowing us to respond to shifts

in market trends much more rapidly

and save time in product development.

Another advantage is managing oper-

ating results in smaller units. As a

semiautonomous profit center, each of

the eight units has its own manage-

ment and operating targets. To save

costs, we have also centralized the

units’ common administrative func-

tions. This gives JVC’s consumer elec-

tronics segment the optimal structure

for allocating resources and executing

strategies. We are now using this

structure to build a more powerful

JVC’s Primary Growth Driver

JVC has prioritized developing prod-

ucts that incorporate higher levels of

added value for some time. The ben-

efits of this strategy began to show

through in fiscal 2003. Large sales

increases were recorded by relatively

new products such as high definition

TVs and plasma display panel (PDP)

TVs. At the same time, well estab-

lished products such as digital video

cameras, car AV equipment and other

audio products, all of which have high

profit margins, turned in a strong per-

formance. This led to operating in-

come in this segment of ¥25.3 billion.

As part of a global program to realign

manufacturing bases over a number of

years, we positioned the Yokosuka

Plant in Japan as the nucleus of all

consumer electronics production, what

we at JVC call the “mother base” of

manufacturing. Its primary mission is

making “Only One” products—items

unique to JVC. As we enact more struc-

tural reforms, we will continue intro-

ducing strategic products that take

JVC to the next phase of growth.

product portfolio, based on the objec-

tive of developing products that rank

among the top three in their respec-

tive categories in all five of JVC’s major

markets: Japan, the US, Europe, Asia

and China.

A Commanding Market Presence

Through “Only One” Products

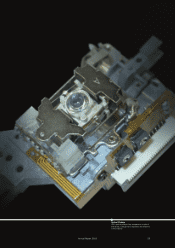

Two elements are essential for creat-

ing “Only One” products that stand out

in the market. First are core technolo-

gies. Second are supplier partners that

recognize the value embodied in these

products. JVC will actively disclose its

future product line and technology

strategies to form closer ties with nu-

merous partners in a dispersed, spe-

cialized supply chain. As part of

creating “Only One” products, we also

revised our previous strategy of offer-

ing a full model selection in each cat-

egory. Our new approach focuses

resources on carefully chosen products.

Today, camcorders, displays and

DVD decks make up JVC’s core prod-

uct categories. Clear strategies exist for

each. In camcorders, our goal is to be

number one worldwide in Mini-DV.