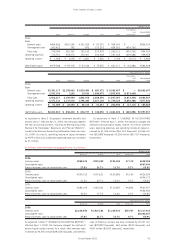

JVC 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Victor Company of Japan, Limited

Annual Report 2003 47

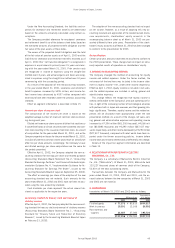

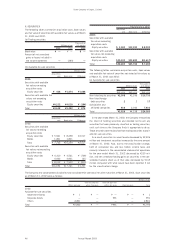

Available-for-sale securities sold in the years ended March 31,

2003, 2002 and 2001 were as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2001 2003

Sales ¥6,247 ¥19,640 ¥16,160 $52,058

Gains 318 763 1,450 2,650

Losses 15 358 640 125

7. INCOME TAXES

Income taxes in Japan consist of corporation, enterprise and

inhabitants’ taxes. The Company and consolidated domestic

subsidiaries are subject to income taxes referred to above, which

in the aggregate, result in the statutory tax rate of approximately

42.0%. Foreign subsidiaries are subject to income taxes of the

countries in which they domicile.

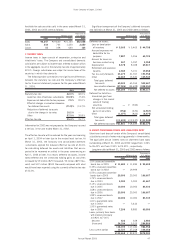

The following table summarizes the significant differences

between the statutory tax rate and the Company’s effective

tax for financial statement purposes for the year ended March

31, 2003.

2003 2001

Statutory tax rate 42.0 % 42.0 %

Lower tax rates of overseas subsidiaries (10.3)% (7.4)%

Expenses not deductible for tax purposes 7.9 % 20.0 %

Effect of changes in valuation allowance

for deferred tax assets (71.9)% (13.7)%

Reduction of deferred tax assets

due to the change in tax rates 10.2 % —

Other 57.5 % 35.8 %

Effective tax rate 35.4 % 76.7 %

Information for 2002 was not prepared as the Company incurred

a net loss in the year ended March 31, 2002.

The effective tax rate will be reduced for the years commencing

on April 1, 2004 or later due to the revised local tax law. At

March 31, 2003, the Company and consolidated domestic

subsidiaries applied the reduced effective tax rate of 40.6%

for calculating deferred tax assets and liabilities that are ex-

pected to be recovered or settled in the years commencing on

April 1, 2004 or later. As a result, deferred tax assets, income

taxes-deferred and net unrealized holding gains on securities

increased by ¥9 million ($75 thousand), ¥3 million ($25 thou-

sand) and ¥12 million ($100 thousand) compared with what

would have been reported using the currently effective tax rate

of 42.0%.

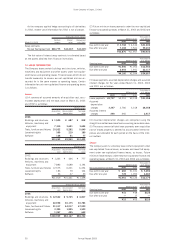

8. SHORT-TERM BANK LOANS AND LONG-TERM DEBT

Short-term bank loans of certain of the Company’s consolidated

subsidiaries consist of notes maturing generally in three months.

The applicable annual interest rates on short-term bank loans

outstanding at March 31, 2003 and 2002 ranged from 1.26%

to 26.42% and from 0.50% to 24.30% , respectively.

Long-term debt at March 31, 2003 and 2002 were as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

1.5% unsecured convertible

bonds due in 2005

¥ 11,483 ¥ 11,483 $ 95,692

0.35% unsecured convertible

bonds due in 2002

—19,999 —

0.55% unsecured convertible

bonds due in 2005

20,000 20,000 166,667

1.75% unsecured bonds

due in 2003

5,000 5,000 41,667

2.15% unsecured bonds

due in 2005

10,000 10,000 83,333

1.68% unsecured bonds

due in 2006

20,000 20,000 166,667

1.89% unsecured bonds

due in 2007

10,000 10,000 83,333

1.61% guaranteed notes

due in 2002

—5,432 —

1.50% guaranteed notes

due in 2005

7,206 8,883 60,050

Loans, primarily from banks

with interest principally

at 0.82% to 7.00%

Secured

322 328 2,683

Unsecured

34,184 5,915 284,866

118,195 117,040 984,958

Less current portion

12,727 27,168 106,058

¥105,468 ¥ 89,872 $878,900

Significant components of the Company’s deferred tax assets

and liabilities at March 31, 2003 and 2002 were as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Deferred tax assets:

Loss on devaluation

of inventory ¥ 5,365 ¥ 5,465 $ 44,708

Accrued expenses not

deductible for tax

purposes 7,887 5,956 65,725

Accrual for losses on

business restructuring 367 5,597 3,058

Depreciation 8,378 8,028 69,817

Retirement and severance

benefits 2,383 5,101 19,858

Tax loss carry forwards 23,275 21,767 193,958

Other 12,665 13,640 105,543

Total gross deferred

tax assets 60,320 65,554 502,667

Less valuation allowance

(37,026) (44,628) (308,550)

Net deferred tax assets

¥23,294 ¥20,926 $194,117

Deferred tax liabilities:

Unrealized gain from

changes in fair market

values of trading

securities —¥ (944) —

Net unrealized holding

gains on securities (356) (670) (2,967)

Other (1,077) (823) (8,975)

Total gross deferred

tax assets ¥ (1,433) ¥ (2,437) $ (11,942)

Net deferred tax assets ¥21,861 ¥18,489 $182,175