Hyundai 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

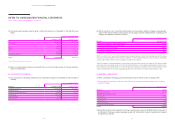

HYUNDAI MOTOR COMPANY Annual Report 2015

174 175

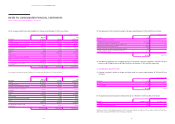

(2) Effects on profit or loss of current and future periods, due from customers related to changes in accounting esti-

mates of total contract revenue and total contract costs of ongoing contracts of Hyundai Rotem, a subsidiary of the

Company, as of December 31, 2015 are as follows:

In millions of Korean Won

Description December 31, 2015

Changes in accounting estimates of total contract revenue ₩ 79,498

Changes in accounting estimates of total contract costs 532,571

Effects on profit or loss of current period (406,706)

Effects on profit or loss of future periods (46,367)

Changes in due from customers (108,863)

Effects on profit or loss of current and future periods were calculated by total contract costs estimated based on the situation

occurred since the commencement of the contract to December 31, 2015 and the estimates of contract revenue as of December

31, 2015. Total contract revenue and costs are subject to change in future periods.

There are changes in accounting estimates of total contract revenue and total contract costs related to CPTM electric multiple

unit project in Sao Paolo, Brazil, as the host of the consortium IESA filed for court receivership and withdrew from the consor-

tium. In December, 2015, Hyundai Rotem, as the host of consortium, entered into a modified contract with the customers, and as

a result, expected total losses has been recognized amounting at ₩ 157,575 million for the year ended December 31, 2015.

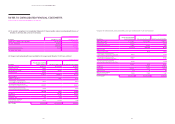

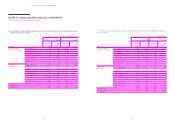

40. BUSINESS COMBINATIONS:

(1) HMNL, a subsidiary of the Company, acquired the business sector of Greenib Car B.V. on January 2, 2015.

1) Considerations for acquisition and the fair value of the assets acquired and liabilities assumed at the acquisition

date are as follows:

In millions of Korean Won

Description Amounts

Considerations transferred ₩ 86,613

Assets acquired and liabilities assumed:

Current assets 80,841

Non-current assets 350

Current liabilities (4,283)

Non-current liabilities (1,600)

Fair value of identifiable net assets 75,308

Goodwill ₩ 11,305

2) During 2015, arising from the acquisition, the Group recognized sales amount of ₩ 208,452 million and net gain of

₩ 1,602 million. The Group recognized receivables amount of ₩ 1,873 million at the time of acquisition and all amount

is expected to be collected.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014

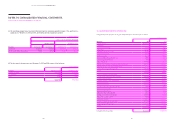

(5) Non-current assets by region where the Group’s entities are located in as of December 31, 2015 and 2014 are as

follows:

In millions of Korean Won

December 31, 2015 December 31, 2014

Korea ₩ 27,735,116 ₩ 21,109,314

North America 2,358,588 2,174,461

Asia 1,153,577 1,129,741

Europe 1,864,713 1,952,153

Others 294,438 399,453

33,406,432 26,765,122

Consolidation adjustments (117,993) (79,000)

Total (*) ₩ 33,288,439 ₩ 26,686,122

(*) Sum of PP&E, intangible assets and investment property.

(6) There is no single external customer who represents 10% or more of the Group’s revenue for the years ended De-

cember 31, 2015 and 2014.

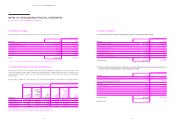

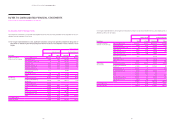

39. CONSTRUCTION CONTRACTS:

(1) Cost, income and loss and claimed construction from construction in progress as of December 31, 2015 and 2014 are

as follows:

In millions of Korean Won

Description December 31, 2015 December 31, 2014

Accumulated accrual cost ₩ 9,774,231 ₩ 7,427,961

Accumulated income 961,631 1,071,348

Accumulated construction in process 10,735,862 8,499,309

Progress billing (9,361,257) (7,172,915)

Due from customers 1,837,280 1,617,221

Due to customers (462,675) (290,827)