Hyundai 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2015

96 97

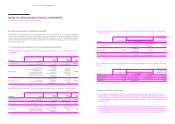

(6) Financial support provided to consolidated structured entities

As of December 31, 2015, Hyundai Card Co., Ltd. and Hyundai Capital Services, Inc., subsidiaries of the Company, have agreements

which provide counterparties with rights to claim themselves in the event of default on the derivatives relating to asset-backed

securities issued by consolidated structured entities, Autopia Forty-Fifth, Forty-Sixth, Forty-Ninth, Fifty-Second, Fifty-Seventh

and Fifty-Ninth Asset Securitization Specialty Company, Privia the Fourth Securitization Specialty Co., Ltd., Super Series First Se-

curitization Specialty Co., Ltd..

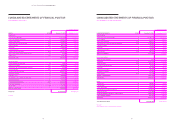

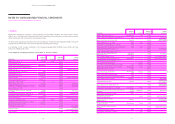

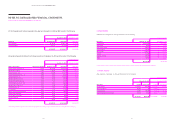

(7) The nature and the risks associated with interests in unconsolidated structured entities

1) Nature of interests in an unconsolidated structured entity, which belongs to the Group as of December 31, 2015 is

as follows:

In millions of Korean Won

Description Purpose

Nature of

business

Method of

funding

Total

assets

Asset securitization SPC Fund raising

through asset securitization

Fund

collection

Corporate

bond and others ₩ 325,752

Investment fund

Investment in

beneficiary certificate and others,

Development trust,

Unspecified monetary trust,

Principal unsecured trust,

Operation of trust investment

Fund management

and operation

and others,

Trust management

and operation,

Payment of trust fee,

Distribution of

trust benefit

Sales of

beneficiary

certificates,

Sales of trust

investment

product

8,823,385

Structured Finance Fund raising

through project financing

Project financing

for construction

project and

ship investment

Project

financing and

others

2,800,091

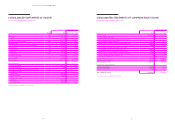

Nature of interests in an unconsolidated structured entity, which belongs to the Group as of December 31, 2014 is as follows:

In millions of Korean Won

Description Purpose

Nature of

business

Method of

funding

Total

assets

Asset securitization SPC Fund raising

through asset securitization

Fund

collection

Corporate

bond and others ₩ 305,457

Investment fund Investment in beneficiary certificate Fund management

and operation

Sales of beneficiary

certificates 13,207,887

Investment trust

Development trust,

Unspecified monetary trust,

Principal unsecured trust,

Operation of trust investment

Trust management

and operation,

Payment of trust fee,

Distribution of

trust benefit

Sales of trust

investment

product

34,442

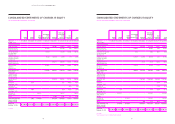

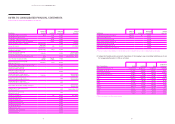

2) Risks associated with interests in an unconsolidated structured entity, which belongs to Group as of December 31,

2015 are as follows:

In millions of Korean Won

Book value in the

structured entity (*)

Financial support provided to the structured entity Maximum amount

of exposure to loss

of the structured entityDescription Method Purpose

Asset securitization SPC ₩ 54,880 Mezzanine

debt and others

Credit facility,

Loan agreement

(Credit line)

₩ 59,897

Investment fund 178,582

Beneficiary

certificates,

Investment trust

Invest

agreement 178,582

Structured Finance 225,897 Loan

obligation

Loan agreement

(Credit line) 336,500

(*) Interest in structured entities is recognized as AFS financial assets and others according to K-IFRS 1039.

Risks associated with interests in an unconsolidated structured entity, which belongs to Group as of December 31, 2014 are as

follows:

In millions of Korean Won

Book value in the

structured entity (*)

Financial support provided to the structured entity Maximum amount

of exposure to loss

of the structured entitDescription Method Purpose

Asset securitization SPC ₩ 31,209 Mezzanine debt Credit facility ₩ 31,209

Investment fund 210,023 Beneficiary certificates Invest agreement 210,023

Investment trust 26,491 Investment trust ˝26,491

(*) Interest in structured entities is recognized as AFS financial assets and others according to K-IFRS 1039.

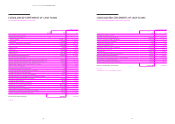

(8) Significant restrictions of the subsidiaries

1) As of December 31, 2015, Hyundai Card Co., Ltd. and Hyundai Capital Services, Inc., subsidiaries of the Compa-

ny have significant restrictions that require them to obtain consent from directors appointed by non-controlling

shareholders in the event of merger, investment in stocks, transfer of the whole or a significant part of assets,

borrowing, guarantee or disposal of assets beyond a certain amount, acquisition of treasury stock, payment of

dividend and so on.

2) As of December 31, 2015, Hyundai Rotem Company, subsidiary of the Company, is required to obtain consent from

directors appointed by non-controlling shareholders in the event of significant change in the capital structure of

the entity, excluding transactions according to the business plan or the regulation of the Board of Directors, such

as issue, disposal, repurchase or retirement of stocks or options, increase or decrease of capital, and so on.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014