Hyundai 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2015

170 171

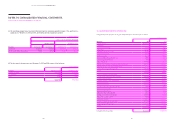

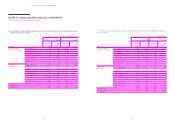

37. COMMITMENTS AND CONTINGENCIES:

(1) As of December 31, 2015 the debt guarantees provided by the Group, excluding the ones provided to the Company’s

subsidiaries are as follows:

In millions of Korean Won

Description Domestic Overseas (*)

To associates -₩ 64,561

To others 11,627 1,201,736

₩ 11,627 ₩ 1,266,297

(*) The guarantee amounts in foreign currency are translated into Korean Won using the Base Rate announced by Seoul Money Brokerage Services, Ltd.

as of December 31, 2015.

(2) As of December 31, 2015, the Group is involved in domestic and foreign lawsuits as a defendant. In addition, the

Group is involved in lawsuits for product liabilities and others. The Group obtains insurance for potential losses

which may result from product liabilities and other lawsuits. Meanwhile, as of December 31, 2015, the Group is cur-

rently involved in lawsuits for ordinary wage, which involves disputes over whether certain elements of remunera-

tion are included in the earnings used for the purposes of calculating overtime, allowances for unused annual paid

leave and retirement benefits, and unable to estimate the outcome or the potential consolidated financial impact.

(3) As of December 31, 2015, a substantial portion of the Group’s PP&E is pledged as collateral for various loans up to

₩ 962,290 million. In addition, the Group pledged certain bank deposits, checks, promissory notes and investment se-

curities, including 213,466 shares of Kia Motors Corporation, as collateral to financial institutions and others. Certain

receivables held by the Company’s foreign subsidiaries, such as financial services receivables are pledged as collat-

eral for their borrowings.

(4) Hyundai Capital Services, Inc., a subsidiary of the Company, has Revolving Credit Facility Agreements with the fol-

lowing financial institutions.

1) Credit Facility Agreement

Hyundai Capital Services, Inc. entered into a Credit Facility Agreement with GE Capital European Funding & CO (the “GE Capital”)

on February 15, 2013 and the agreement had been renewed on January 9, 2015. The credit line of the agreement is Euro worth of

USD 600 million as of December 31, 2015. The entity will be able to extend the agreement until January 5, 2018 annually. Other-

wise, it will be automatically terminated. The agreement was expired at January 8, 2016.

2) Revolving Credit Facility

Hyundai Capital Services, Inc. has a Revolving Credit Facility Agreement which credit line is USD 200 million, EUR 10 million and

₩ 1,775,000 million with Kookmin Bank and 21 other financial institutions, as of December 31, 2015.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014

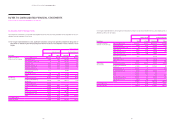

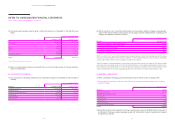

(3) Significant fund transactions and equity contribution transactions for the year ended December 31, 2015, between

the Group and related parties are as follows:

In thousands of U.S. Dollars, In millions of Korean Won

Description

Loans Borrowings

Equity

contributionLending Collection Borrowing Repayment

Entity with significant

influence over the Company -$ 60,000 - - -

Joint ventures and associates - - - - 366,439

Significant fund transactions and equity contribution transactions for the year ended December 31, 2014, between the Group and

related parties are as follows:

In thousands of U.S. Dollars, In millions of Korean Won

Description

Loans Borrowings

Equity

contributionLending Collection Borrowing Repayment

Joint ventures and associates - - - $ 362 ₩ 130,417

During 2015, the Group traded in other financial assets and others of ₩ 2,650,000 million with HMC Investment Securities Co.,

Ltd., an associate of the Group. The Group has other financial assets of ₩ 1,910,000 million in the consolidated statements of fi-

nancial position as of December 31, 2015.

(4) Compensation of registered and unregistered directors, who are considered to be the key management personnel for

the years ended December 31, 2015 and 2014 are as follows:

In millions of Korean Won

Description 2015 2014

Short-term employee salaries ₩ 198,063 ₩ 178,844

Post-employment benefits 37,888 33,179

Other long-term benefits 510 623

₩ 236,461 ₩ 212,646