Hyundai 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2015

92 93

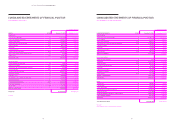

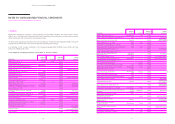

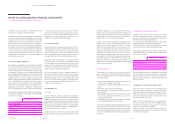

Subsidiaries

Nature of

business Location

Ownership

percentage

Indirect

ownership

Hyundai Motor Espana. S.L.U. (HMES) Sales Spain 100.00%

Hyundai Motor France SAS (HMF) ˝France 100.00%

Hyundai Motor Poland Sp. Zo. O (HMP) ˝Poland 100.00%

Hyundai Motor DE Mexico S DE RL DE CV (HMM) ˝Mexico 100.00% HT 0.01%

Hyundai de Mexico, SA DE C.V., (HYMEX) Manufacturing ˝99.99% HT 99.99%

Hyundai Rio Vista, Inc. Real estate

development USA 100.00% HT 100.00%

Hyundai Motor Brasil Montadora de

Automoveis LTDA (HMB) Manufacturing Brazil 100.00%

Hyundai Capital Brasil Servicos De

Assistencia Financeira Ltda Financing ˝100.00% Hyundai Capital

Services 100.00%

Hyundai Rotem Brasil Servicos de Engenharia Ltda. Sales ˝100.00% Hyundai Rotem 100.00%

China Millennium Corporations (CMEs) Holding

company

Cayman

Islands 59.60%

KyoboAXA Private Tomorrow Securities

Investment Trust No.12 Investment Korea 100.00%

UBS Hana Dynamic Balance Private Investment Trust 1 ˝ ˝ 100.00%

Shinhan BNPP Private Corporate

Security Investment Trust No.34 ˝ ˝ 100.00%

Miraeasset Triumph Private Equity

Security Investment Trust No.15 ˝ ˝ 100.00%

Autopia Forty-Fourth ~ Forty-Seventh

Asset Securitization Specialty Company (*) Financing ˝0.90% Hyundai Capital

Services 0.90%

Autopia Forty-Ninth ~ Fifty-Second

Asset Securitization Specialty Company (*) ˝ ˝ 0.50% Hyundai Capital

Services 0.50%

Autopia Fifty-Fourth ~ Fifty-Ninth

Asset Securitization Specialty Company (*) ˝ ˝ 0.50% ˝

HB the Fourth Securitization Specialty Company (*) ˝ ˝ 0.31% Hyundai Capital

Services 0.31%

Privia the Fourth ~ Fifth Securitization

Specialty Co., Ltd. (*) ˝ ˝ 0.50% Hyundai Card 0.50%

Super Series First Securitization

Specialty Co., Ltd. (*) ˝ ˝ 0.50% ˝

Hyundai CHA Funding, LLC ˝USA 100.00% HCA 100.00%

Hyundai Lease Titling Trust ˝ ˝ 100.00% ˝

Hyundai HK Funding, LLC ˝ ˝ 100.00% ˝

Hyundai HK Funding Two, LLC ˝ ˝ 100.00% ˝

Hyundai HK Funding Three, LLC ˝ ˝ 100.00% ˝

Hyundai ABS Funding, LLC ˝ ˝ 100.00% ˝

HK Real Properties, LLC ˝ ˝ 100.00% ˝

Hyundai Auto Lease Offering, LLC ˝ ˝ 100.00% ˝

Hyundai HK Lease, LLC ˝ ˝ 100.00% ˝

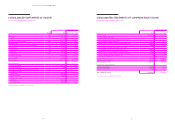

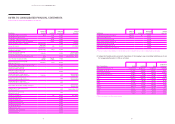

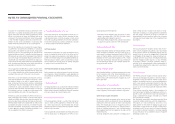

Subsidiaries

Nature of

business Location

Ownership

percentage

Indirect

ownership

Extended Term Amortizing Program, LLC Financing USA 100.00% ˝

Hyundai Protection Plan, Inc. Insurance ˝100.00% ˝

Hyundai Protection Plan Florida, Inc. ˝ ˝ 100.00% ˝

Hyundai Capital Insurance Services, LLC ˝ ˝ 100.00% ˝

Hyundai Capital Insurance Company ˝ ˝ 100.00% ˝

Power Protect Extended Services, Inc. ˝ ˝ 100.00% ˝

Power Protect Extended Services Florida, Inc. ˝ ˝ 100.00% ˝

(*) The Group is considered to have substantial control over the entities by virtue of an agreement with other investors or relationship with structured entities.

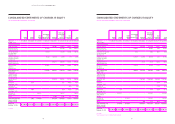

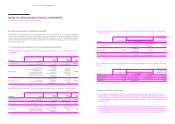

(2) Summarized financial position and results of operations of the Company’s major consolidated subsidiaries as of and

for the yearended December 31, 2015 are as follows:

In millions of Korean Won

Name of subsidiaries Assets Liabilities Sales

Profit (loss)

for the year

Hyundai Capital Services, Inc. (*) ₩ 24,307,583 ₩ 20,812,697 ₩ 2,939,138 ₩ 276,714

Hyundai Card Co., Ltd. (*) 13,351,438 10,857,406 2,652,891 186,762

Hyundai Rotem Company (*) 5,043,947 3,606,282 3,309,109 (304,495)

Hyundai KEFICO Corporation (*) 1,275,832 754,598 1,805,984 24,298

HCA (*) 37,447,867 34,533,886 7,012,831 214,868

HMA 7,800,728 5,065,377 17,079,229 (162,823)

HMMA 3,675,429 1,344,568 7,509,545 282,045

HMMC 3,157,780 1,357,009 5,793,632 267,587

HMI (*) 2,334,518 1,133,387 5,403,944 190,455

HME (*) 1,540,119 1,529,807 7,334,788 4,406

HACC (*) 1,033,652 571,390 2,809,899 54,326

HMMR 958,083 703,679 1,930,074 (17,626)

HMCA 778,638 560,469 1,903,433 30,695

(*) Based on the subsidiary’s consolidated financial statements.

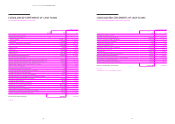

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014