Hyundai 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2015

106 107

investment in an associate. There is no remeasurement to fair

value upon such changes in ownership interests.

Unrealized gains from transactions between the Group and its

associates or joint ventures are eliminated up to the shares

in associate (joint venture) stocks. Unrealized losses are also

eliminated unless evidence of impairment in assets trans-

ferred is produced. If the accounting policy of associates or

joint ventures differs from the Group, financial statements

are adjusted accordingly before applying equity method of

accounting. If the Group’s ownership interest in an associate

or a joint venture is reduced, but the significant influence is

continued, the Group reclassifies to profit or loss only a pro-

portionate amount of the gain or loss previously recognized in

other comprehensive income.

(12) Property, plant and equipment

Property, plant and equipment is to be recognized if, and only if

it is probable that future economic benefits associated with the

asset will flow to the Group, and the cost of the asset can be

measured reliably. After the initial recognition, property, plant

and equipment is stated at cost less accumulated depreciation

and accumulated impairment losses. The cost includes any cost

directly attributable to bringing the asset to the location and

condition necessary for it to be capable of operating in the

manner intended by management and the initial estimate of the

costs of dismantling and removing the item and restoring the

site on which it is located. In addition, in case the recognition

criteria are met, the subsequent costs will be added to the car-

rying amount of the asset or recognized as a separate asset,

and the carrying amount of what was replaced is derecognized.

Depreciation is computed using the straight-line method based

on the estimated useful lives of the assets. The representative

useful lives are as follows:

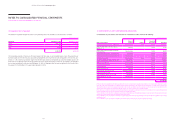

Representative useful lives (years)

Buildings and structures 2 - 50

Machinery and equipment 2 - 30

Vehicles 2 - 20

Dies, molds and tools 2 - 20

Office equipment 2 - 15

Other 2 - 30

The Group reviews the depreciation method, the estimated

useful lives and residual values of property, plant and equip-

ment at the end of each annual reporting period. If expec-

tations differ from previous estimates, the changes are ac-

counted for as a change in accounting estimate.

(13) Investment property

Investment property is property held to earn rentals or for

capital appreciation or both. An investment property is mea-

sured initially at its cost and transaction costs are included

in the initial measurement. After initial recognition, the book

value of investment property is presented at the cost less ac-

cumulated depreciation and accumulated impairment losses.

Subsequent costs are recognized as the carrying amount

of the asset when, and only when it is probable that future

economic benefits associated with the asset will flow to the

Group, and the cost of the asset can be measured reliably, or

recognized as a separate asset if appropriate. The carrying

amount of what was replaced is derecognized.

Land is not depreciated, and other investment properties are

depreciated using the straight-line method over the peri-

od from 20 to 50 years. The Group reviews the depreciation

method, the estimated useful lives and residual values at the

end of each annual reporting period. If expectations differ

from previous estimates, the changes are accounted for as a

change in accounting estimate.

(14) Intangible assets

1) Goodwill

Goodwill arising from a business combination is recognized as

an asset at the time of obtaining control (the acquisition-date).

Goodwill is measured as the excess of the aggregate of the

consideration transferred, the amount of any non-controlling

interest in the acquiree, and the acquisition-date fair value of

the Group’s previously held equity interest in the acquiree over

the net of the acquisition-date amounts of the identifiable as-

sets acquired and the liabilities assumed.

If, after reassessment, the net of the acquisition-date amounts

of the identifiable assets acquired and the liabilities assumed

exceeds the aggregate of the consideration transferred, the

amount of any non-controlling interest in the acquiree, and

the acquisition-date fair value of the Group’s previously held

equity interest in the acquiree, the excess is recognized imme-

diately in profit or loss as a bargain purchase gain.

Goodwill is not amortized but tested for impairment at least

annually. For purposes of impairment tests, goodwill is allo-

cated to those cash generating units (“CGU”) of the Group

expected to have synergy effect from the business combi-

nation. CGU that goodwill has been allocated is tested for

impairment every year or when an event occurs that indicates

impairment. If recoverable amount of a CGU is less than its

carrying amount, the impairment will first decrease the good-

will allocated to that CGU and the remaining impairment will

be allocated among other assets relative to its carrying value.

Impairment recognized for goodwill may not be reversed.

When disposing a subsidiary, related goodwill will be included

in gain or loss from disposal.

2) Development costs

The expenditure on research is recognized as an expense

when it is incurred. The expenditure on development is recog-

nized as an intangible asset if, and only if, all of the following

can be demonstrated:

● the technical feasibility of completing the intangible asset

so that it will be available for use or sale;

● the intention to complete the intangible asset and use or

sell it;

● the ability to use or sell the intangible asset;

● how the intangible asset will generate probable future eco-

nomic benefits;

● the availability of adequate technical, financial and other

resources to complete the development and to use or sell

the intangible asset; and

● the ability to measure reliably the expenditure attributable

to the intangible asset during its development.

The cost of an internally generated intangible asset is the sum

of the expenditure incurred from the date when the intangible

asset first meets the recognition criteria above and the carry-

ing amount of intangible assets is presented as the acquisition

cost less accumulated amortization and accumulated impair-

ment losses.

3) Intangible assets acquired separately

Intangible assets that are acquired separately are carried at

cost less accumulated amortization and accumulated impair-

ment losses. Amortization is recognized using the straight-line

method based on the estimated useful lives.

The Group reviews the estimated useful life and amortization

method at the end of each annual reporting period.

If expectations differ from previous estimates, the changes

are accounted for as a change in accounting estimate.

Amortization is computed using the straight line method based

on the estimated useful lives of the assets. The representative

useful lives are as follows:

Representative useful lives (years)

Development costs 3 - 6

Industrial property rights 4 - 13

Software 2 - 20

Other 2 - 40

Club membership included in other intangible assets is deemed

to have an indefinite useful life as there is no foreseeable

limit on the period over which the membership is expected to

generate economic benefit for the Group, therefore the Group

does not amortize it.

(15) Impairment of tangible and intangible assets

The Group assesses at the end of each reporting period

whether there is any indication that an asset may be impaired.

If any such indication exists, the Group estimates the recov-

erable amount of the asset to determine the extent of the im-

pairment loss. Recoverable amount is the higher of fair value

less costs to sell and value in use.

If the cash inflow of individual asset occurs separately from

other assets or group of assets, the recoverable amount is

measured for that individual asset; otherwise, it is measured

for each CGU to which the asset belongs.

Except for goodwill, all non-financial assets that have in-

curred impairment are tested for reversal of impairment at the

end of each reporting period.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014