Hyundai 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2015

142 143

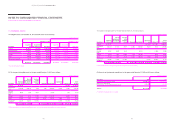

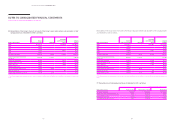

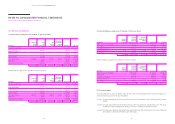

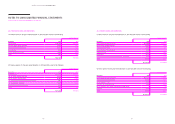

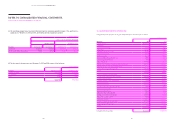

Fair value measurements of financial instruments by fair value hierarchy levels as of December 31, 2015 are as follows:

In millions of Korean Won

Description

December 31, 2015

Level 1 Level 2 Level 3 Total

Financial assets:

Financial assets at FVTPL ₩ 90,363 ₩ 10,044,865 -₩ 10,135,228

Derivatives designated as

hedging instruments -220,824 -220,824

AFS financial assets 2,202,249 171,011 232,557 2,605,817

₩ 2,292,612 ₩ 10,436,700 ₩ 232,557 ₩ 12,961,869

Financial liabilities:

Financial liabilities at FVTPL -₩ 37,448 -₩ 37,448

Derivatives designated as

hedging instruments -161,290 -161,290

-₩ 198,738 -₩ 198,738

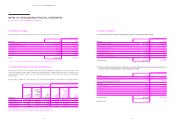

Fair value measurements of financial instruments by fair value hierarchy levels as of December 31, 2014 are as follows:

In millions of Korean Won

Description

December 31, 2014

Level 1 Level 2 Level 3 Total

Financial assets:

Financial assets at FVTPL ₩ 106,293 ₩ 14,751,430 -₩ 14,857,723

Derivatives designated as

hedging instruments -39,002 -39,002

AFS financial assets 1,877,566 141,017 247,483 2,266,066

₩ 1,983,859 ₩ 14,931,449 ₩ 247,483 ₩ 17,162,791

Financial liabilities:

Financial liabilities at FVTPL -₩ 10,331 -₩ 10,331

Derivatives designated as

hedging instruments -414,029 -414,029

-₩ 424,360 -₩ 424,360

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014

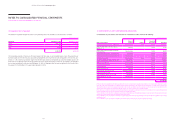

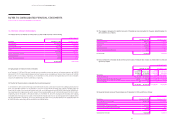

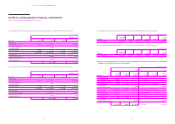

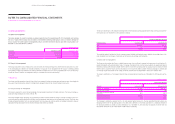

The changes in financial instruments classified as Level 3 for the year ended December 31, 2015 are as follows:

In millions of Korean Won

Description

Beginning

of the year Purchases Disposals Valuation Transfers

End of

the year

AFS financial assets ₩ 247,483 ₩ 5,840 ₩ (17,929) ₩ (2,837) -₩ 232,557

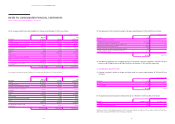

The changes in financial instruments classified as Level 3 for the year ended December 31, 2014 are as follows:

In millions of Korean Won

Description

Beginning

of the year Purchases Disposals Valuation Transfers

End of

the year

AFS financial assets ₩ 229,342 ₩ 12,547 ₩ (183) ₩ (9,428) ₩ 15,205 ₩ 247,483

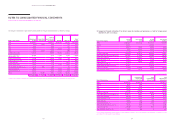

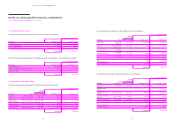

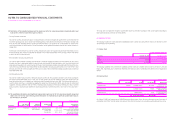

(4) Interest income, dividend income and interest expenses by categories of financial instruments for the years ended

December 31, 2015 and 2014 consist of the following:

In millions of Korean Won

Description

2015 2014

Interest

income

Dividend

income

Interest

expenses

Interest

income

Dividend

income

Interest

expenses

Non-financial services:

Loans and receivables ₩ 184,248 - - ₩ 235,429 - -

Financial assets at FVTPL 305,580 - - 415,673 - -

AFS financial assets 1,048 13,783 -1,321 29,860 -

Financial liabilities

carried at amortized cost - - 193,689 - - 198,501

₩ 490,876 ₩ 13,783 ₩ 193,689 ₩ 652,423 ₩ 29,860 ₩ 198,501

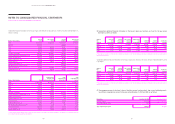

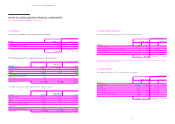

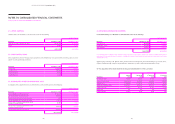

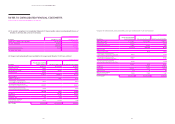

Financial services:

Loans and receivables ₩ 2,423,534 - - ₩ 2,467,008 - -

Financial assets at FVTPL 27,197 1,370 -28,807 - -

AFS financial assets 1,202 5,533 -1,197 - -

Financial liabilities

carried at amortized cost - - 1,301,618 - - 1,340,995

₩ 2,451,933 ₩ 6,903 ₩ 1,301,618 ₩ 2,497,012 -₩ 1,340,995