Hyundai 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2015

120 121

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014

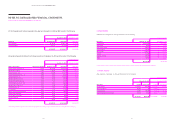

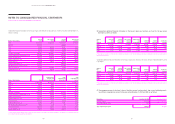

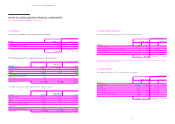

10. INVESTMENT PROPERTY:

(1) Investment property as of December 31, 2015 and 2014 consist of the following:

In millions of Korean Won

Description

December 31, 2015 December 31, 2014

Acquisition

cost

Accumulated

depreciation Book value

Acquisition

cost

Accumulated

depreciation Book value

Land ₩ 59,631 -₩ 59,631 ₩ 63,406 -₩ 63,406

Buildings 400,602 (181,769) 218,833 398,626 (153,193) 245,433

Structures 18,630 (5,670) 12,960 18,630 (5,262) 13,368

₩ 478,863 ₩ (187,439) ₩ 291,424 ₩ 480,662 ₩ (158,455) ₩ 322,207

(2) The changes in investment property for the year ended December 31, 2015 are as follows:

In millions of Korean Won

Description

Beginning

of the year Transfers Disposals Depreciation

Effect of foreign

exchange

differences

End of

the year

Land ₩ 63,406 ₩ (3,886) - - ₩ 111 ₩ 59,631

Buildings 245,433 (16,275) -(12,858) 2,533 218,833

Structures 13,368 - - (408) -12,960

₩ 322,207 ₩ (20,161) -₩ (13,266) ₩ 2,644 ₩ 291,424

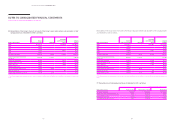

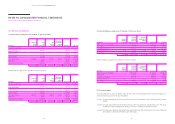

The changes in investment property for the year ended December 31, 2014 are as follows:

In millions of Korean Won

Description

Beginning

of the year Transfers Disposals Depreciation

Effect of foreign

exchange

differences

End of

the year

Land ₩ 62,467 ₩ 3,617 ₩ (2,836) -₩ 158 ₩ 63,406

Buildings 187,741 67,373 -(10,722) 1,041 245,433

Structures 13,776 - - (408) -13,368

₩ 263,984 ₩ 70,990 ₩ (2,836) ₩ (11,130) ₩ 1,199 ₩ 322,207

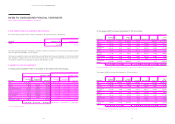

(3) The fair value of investment property as of December 31, 2015 and 2014 consist of the following:

In millions of Korean Won

Description December 31, 2015 December 31, 2014

Land ₩ 59,631 ₩ 64,783

Buildings 434,383 436,271

Structures 15,496 15,514

₩ 509,510 ₩ 516,568

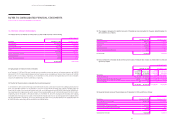

The fair value measurement of the investment property was performed by an independent third party. The Group deems the

change in fair value from the fair value measurement performed at the initial recognition of the investment property is not mate-

rial.

The fair value of the investment property is classified as Level 3, based on the inputs used in the valuation techniques. The fair

value has been determined based on the cost approach and the market approach. The cost approach measured fair value as cur-

rent replacement cost considering supplementary installation, depreciation period, structure and design.

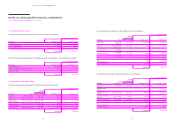

(4) Income and expenses related to investment property for the years ended December 31, 2015 and 2014 are as follows:

In millions of Korean Won

Description 2015 2014

Rental income ₩ 57,366 ₩ 42,499

Operating and maintenance expenses 14,449 19,433