Holiday Inn 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP FINANCIAL

STATEMENTS

Notes to the Group financial statements 81

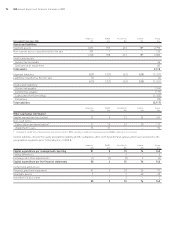

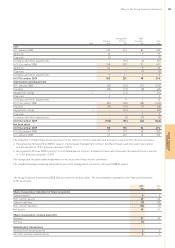

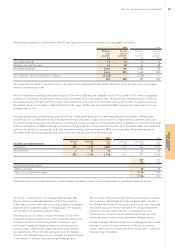

10 Property, plant and equipment

Land and Fixtures, fittings

buildings and equipment Total

Note $m $m $m

Cost

At 1 January 2008 1,606 955 2,561

Additions 68591

Net transfers to non-current assets classified as held for sale (119) (60) (179)

Disposals (15) (24) (39)

Exchange and other adjustments (112) (56) (168)

At 31 December 2008 1,366 900 2,266

Additions 22 35 57

Net transfers from non-current assets classified as held for sale 176 104 280

Reclassification 14 (14) –

Disposals – (3) (3)

Exchange and other adjustments 44 24 68

At 31 December 2009 1,622 1,046 2,668

Depreciation and impairment

At 1 January 2008 (129) (498) (627)

Provided (11) (61) (72)

Net transfers to non-current assets classified as held for sale 37 37 74

Impairment charge a(12) – (12)

On disposals 15 25 40

Exchange and other adjustments – 15 15

At 31 December 2008 (100) (482) (582)

Provided (11) (60) (71)

Net transfers from non-current assets classified as held for sale (44) (45) (89)

Impairment charge b(28) – (28)

Valuation adjustments arising on reclassification from held for sale (note 11) (28) (17) (45)

On disposals –22

Exchange and other adjustments (1) (18) (19)

At 31 December 2009 (212) (620) (832)

Net book value

At 31 December 2009 1,410 426 1,836

At 31 December 2008 1,266 418 1,684

At 1 January 2008 1,477 457 1,934

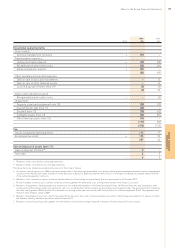

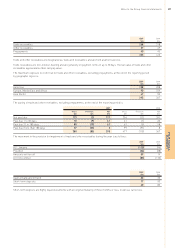

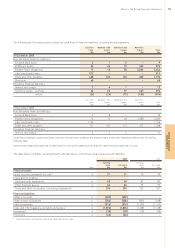

The impairment charges have arisen as a result of the current economic downturn and a re-assessment of the recoverable amount

of certain properties, based on value in use, as follows:

a Recognised at 31 December 2008 in respect of a North American hotel. Estimated future cash flows were discounted

at a pre-tax rate of 13.5%.

b Recognised at 30 June 2009, comprising $20m in respect of a North American hotel and $8m relating to a European hotel.

Estimated future cash flows were discounted at pre-tax rates of 14.0% and 12.5% respectively.

These charges are included within impairment on the face of the Group income statement.

The carrying value of land and buildings held under finance leases at 31 December 2009 was $187m (2008 $192m).

The carrying value of assets in the course of construction was $nil (2008 $41m).

No borrowing costs were capitalised during the year (2008 $nil).