Holiday Inn 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 IHG Annual Report and Financial Statements 2009

Business review continued

Americas results

The Americas

Americas strategic role 2010 priorities

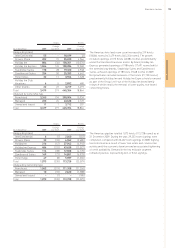

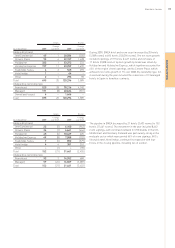

12 months ended 31 December

2009 2008 %

$m $m change

Revenue

Franchised 437 495 (11.7)

Managed 110 168 (34.5)

Owned and leased 225 300 (25.0)

Total 772 963 (19.8)

Operating profit before exceptional items

Franchised 364 426 (14.6)

Managed (40) 51 (178.4)

Owned and leased 11 55 (80.0)

335 532 (37.0)

Regional overheads (47) (67) 29.9

Total 288 465 (38.1)

Americas comparable RevPAR movement on previous year

12 months ended

31 December 2009

Franchised

Crowne Plaza (15.9)%

Holiday Inn (15.5)%

Holiday Inn Express (12.9)%

All brands (14.3)%

Managed

InterContinental (16.2)%

Crowne Plaza (19.2)%

Holiday Inn (17.0)%

Staybridge Suites (14.8)%

Candlewood Suites (22.8)%

All brands (17.8)%

Owned and leased

InterContinental (28.2)%

Revenue and operating profit before exceptional items decreased

by 19.8% to $772m and 38.1% to $288m respectively. Excluding the

receipt of significant liquidated damages of $13m in 2008, revenue

and operating profit declined by 18.7% and 36.3% respectively.

The region experienced challenging trading conditions throughout

the year leading to RevPAR, revenue and profit declines across all

ownership types. Despite RevPAR declines, the region’s US comparable

hotels demonstrated outperformance relative to the US market.

Franchised revenue and operating profit decreased by 11.7% to

$437m and 14.6% to $364m respectively, compared to 2008. This

decrease was predominantly driven by a fall in royalty revenues as

a consequence of a RevPAR decline of 14.3%. Revenues also

included the impact of a decline in real estate activity leading to

lower fees associated with activities such as the signing of new

hotels and conversions. An increase in overall room supply partially

offset the decline in revenue and profit.

Managed revenues decreased by 34.5% to $110m during the year

or, by 29.0% excluding the impact of $13m in liquidated damages

received in 2008. All brands were impacted by the economic

downturn which resulted in RevPAR declines of 17.8%. Operating

profit declined by $91m ($78m excluding liquidated damages)

resulting in a loss of $40m. The loss was due to RevPAR driven

revenue declines, IHG funding owner’s priority return shortfalls on

a number of hotels managed by one owner and certain guarantee

payments. At the year end, an exceptional charge of $91m was

recognised comprising the write off of a deposit related to the priority

return contracts and the total estimated net cash outflows to this

owner under the guarantee. Therefore, future payments to this

owner will be charged against the provision and will not impact

operating results. The managed results also included the impact of

provisions recognised following the devaluation of the Venezuelan

currency and the potential impact of asset nationalisation.

Results from managed operations included revenues of $71m

(2008 $88m) and operating profit of $nil (2008 $6m) from properties

that are structured, for legal reasons, as operating leases but with

the same characteristics as management contracts.

Owned and leased revenue declined by 25.0% to $225m and

operating profit decreased by 80.0% to $11m. Underlying trading

was driven by RevPAR declines, including the InterContinental

brand with a decline of 28.2%. Trading at the InterContinental New

York, in particular, was severely impacted by the collapse of the

financial markets. Results also included the impact of the sale

of the Holiday Inn Jamaica, sold in August 2008, which led to a

reduction in revenue and operating profit of $16m and $2m

respectively when compared to 2008.

As a result of the declining real estate market, the InterContinental

Atlanta and Staybridge Suites Denver Cherry Creek no longer

meet the criteria for designation as held for sale assets and

consequently the results of these hotels are no longer categorised

as discontinued operations and comparative figures have been

re-presented accordingly.

Regional overheads declined by 29.9% during the year, from $67m

to $47m. The favourable movement was driven by increased

efficiencies and the impact of an organisational restructuring

undertaken to further align the regional structure with the

requirements of IHG’s owners and hotels.

•Complete the roll-out of Holiday Inn repositioning;

•cascade Great Hotels Guests Love to the hotel level;

•optimise IHG’s growth and development efforts; and

•focus upscale distribution growth across the InterContinental,

Crowne Plaza and Hotel Indigo brands.

To optimise our core business and cash flow-generating

capability by focusing primarily on our substantial midscale

franchise business and profitable brand extensions

and adjacencies.