Holiday Inn 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 IHG Annual Report and Financial Statements 2009

The Directors present their report for the financial year ended

31 December 2009.

Certain information required for disclosure in this report is

provided in other appropriate sections of the Annual Report and

Financial Statements 2009. These include the Business Review, the

Corporate Governance and Remuneration Reports and the Group

financial statements, and these are, accordingly, incorporated into

this report by reference.

Activities of the Group

The principal activities of the Group are in hotels and resorts, with

franchising, management, ownership and leasehold interests in

over 4,400 establishments, with almost 650,000 guest rooms in

over 100 countries and territories around the world.

Business review

This Directors’ Report should be read in conjunction with the

Chairman’s statement and the Chief Executive’s review on pages

3 to 5, and the Business Review on pages 8 to 34. Taken together,

these provide a fair review of the Group’s strategy and business,

significant developments during the year and a description of the

principal risks and uncertainties it faces. The development and

performance of the business during and at the end of the year

are described, together with main trends, factors and likely

developments, key performance indicators, environmental and

employee matters, and social and community issues.

Results and dividends

The operating profit before exceptional items was $363m: the

Group’s income statement is set out on page 60 of the Group

financial statements. An interim dividend of 7.3p per share

(12.2 cents per ADR) was paid on 2 October 2009. The Directors

are recommending a final dividend of 18.7p per share (29.2 cents

per ADR) to be paid on 4 June 2010 to shareholders on the Register

of Members at the close of business on 26 March 2010. Total

dividends relating to the year are expected to amount to $119m.

Share capital

During the year, 1,423,874 new shares were issued under employee

share plans. The Company’s issued share capital at 31 December

2009 consisted of 286,976,067 ordinary shares of 13 29⁄47p each.

There are no special control rights or restrictions on transfer

attaching to these ordinary shares.

IHG operates an Employee Share Option Trust (ESOT) for the

benefit of employees and former employees. The ESOT purchases

shares in the market and releases them to current and former

employees in satisfaction of share awards. During the year, the

ESOT released 3,058,848 shares and at 31 December 2009 it held

283,895 shares in the Company. The ESOT adopts a prudent

approach to purchasing shares, using funds provided by the Group,

based on expectations of future requirements.

No awards or grants over shares were made during 2009 that

would be dilutive of the Company’s ordinary share capital. Current

policy is to settle the majority of awards or grants under the

Company’s share plans with shares purchased in the market.

A number of options granted up to 2005 are yet to be exercised

and will be settled with the issue of new shares.

The Company has not utilised the authority given by shareholders

at any of its Annual General Meetings to allot shares for cash

without first offering such shares to existing shareholders.

Share repurchases

During 2009, the Company continued to defer the remaining £30m

of its £150m share repurchase programme in order to preserve

cash and maintain the strength of IHG’s balance sheet.

No shares were purchased or cancelled under the authority

granted by shareholders at the Annual General Meeting held on

29 May 2009. The share buyback authority remains in force until

the Annual General Meeting in 2010, and a resolution to renew

the authority will be put to shareholders at that Meeting.

Substantial shareholdings

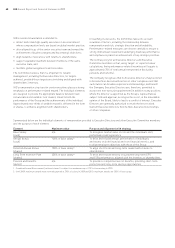

As at 15 February 2010, the Company had been notified, in

accordance with the Disclosure and Transparency Rules of the

UK Financial Services Authority, of the following significant

holdings representing 3% or more of its issued share capital:

Ellerman Corporation Limited 10.00% Direct interest

FIL Limited 5.14% Direct interest

BlackRock, Inc. 5.11% Indirect interest

Cedar Rock Capital Limited 5.07% Direct interest

Legal & General Group Plc 3.96% Direct interest

Lloyds Banking Group plc 3.84% Direct and

indirect interest

Longleaf Partners Fund 3.74% Direct interest

Directors

Details of Directors who served on the Board during the year are

shown on page 36. Details of the beneficial share interests of

Directors who were on the Board at the year end are shown below.

No changes to these interests occurred between the year end and

the date of this Report.

31 December 2009

InterContinental Hotels Group PLC

ordinary shares1

Executive Directors

Andrew Cosslett 419,927

Richard Solomons 322,743

Non-Executive Directors

David Kappler 1,400

Ralph Kugler 1,169

Jennifer Laing 3,373

Jonathan Linen 7,3432

David Webster 34,117

Ying Yeh –

1 These shareholdings are all beneficial interests and include shares

held by Directors’ spouses and other connected persons. None of the

Directors has a beneficial interest in the shares of any subsidiary. These

shareholdings do not include Executive Directors’ entitlements to share

awards under the Company’s share plans, which are set out separately

in the Remuneration Report on pages 55 and 56.

2 Held in the form of American Depositary Receipts.

Directors’ report