Holiday Inn 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review 13

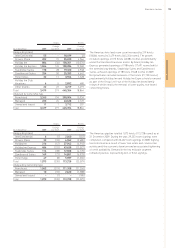

Global hotel and room count

Global pipeline

Hotels Rooms

Change Change

At 31 December 2009 over 2008 2009 over 2008

Analysed by brand

InterContinental 166 756,121 1,385

Crowne Plaza 366 24 100,994 7,612

Holiday Inn 1,319 (34) 240,568 (9,123)

Holiday Inn Express 2,069 137 188,007 14,213

Staybridge Suites 182 30 19,885 3,241

Candlewood Suites 254 50 25,283 4,642

Hotel Indigo 33 11 4,030 1,328

Holiday Inn Club

Vacations 652,892 480

Other 43 22 8,899 3,050

Total 4,438 252 646,679 26,828

Analysed by ownership type

Franchised 3,799 214 483,541 17,574

Managed 622 37 157,287 9,047

Owned and leased 17 15,851 207

Total 4,438 252 646,679 26,828

During 2009, the IHG global system (the number of hotels and

rooms which are franchised, managed, owned or leased by the

Group) increased by 252 hotels (26,828 rooms; 4.3%) to 4,438 hotels

(646,679 rooms). Openings of 439 hotels (55,345 rooms) were

focused, in particular, on continued expansion in the US and China.

System growth was driven by brands in the midscale limited

service and extended stay segments. Holiday Inn Express

represented over 50% of total net growth (137 hotels, 14,213

rooms), whilst Staybridge Suites and Candlewood Suites combined

represented approximately 30% (80 hotels, 7,883 rooms). IHG’s

lifestyle brand, Hotel Indigo, achieved net growth of approximately

50%, with 11 hotels (1,328 rooms) added during the year.

Significant progress has been achieved on the Holiday Inn brand

family relaunch with 1,697 hotels open under the updated signage

and brand standards as at 31 December 2009. The relaunch aims

to refresh the brand and to deliver consistent best in class service

and enhanced physical quality in all Holiday Inn and Holiday Inn

Express hotels.

Non-brand conforming hotels continued to be removed from the

system; global removals totalled 187 hotels (28,517 rooms) during

2009, predominantly Holiday Inn and Holiday Inn Express hotels.

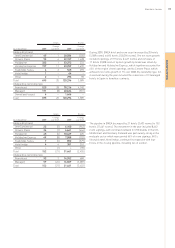

Hotels Rooms

Change Change

At 31 December 2009 over 2008 2009 over 2008

Analysed by brand

InterContinental 63 (8) 20,173 (1,711)

Crowne Plaza 129 (4) 38,555 (2,914)

Holiday Inn 338 (49) 59,008 (5,253)

Holiday Inn Express 563 (156) 57,756 (12,514)

Staybridge Suites 123 (43) 13,360 (4,749)

Candlewood Suites 169 (73) 14,851 (6,939)

Hotel Indigo 53 (3) 6,660 (552)

Other –(1) –(90)

Total 1,438 (337) 210,363 (34,722)

Analysed by ownership type

Franchised 1,158 (316) 126,386 (30,573)

Managed 280 (20) 83,977 (3,964)

Owned and leased –(1) –(185)

Total 1,438 (337) 210,363 (34,722)

Global pipeline signings

Hotels Rooms

Change Change over

At 31 December 2009 over 2008 2009 2008

Total 345 (348) 52,891 (45,995)

At the end of 2009, the IHG pipeline totalled 1,438 hotels

(210,363 rooms). The IHG pipeline represents hotels and rooms

where a contract has been signed and the appropriate fees paid.

Terminations in the pipeline occur for a number of reasons such

as withdrawal of financing and changes in local market conditions.

IHG maintained a strong level of new signings despite the impact of

the global economic downturn, demonstrating continued demand

for IHG brands and represents a key driver of future profitability.

In the year, signings across all regions of 52,891 rooms were added

to the pipeline. Overall, the opening of 55,345 rooms, combined

with an increase in pipeline terminations, resulted in a net pipeline

decline of 34,722 rooms.

BUSINESS REVIEW