Holiday Inn 2009 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 IHG Annual Report and Financial Statements 2009

Business review continued

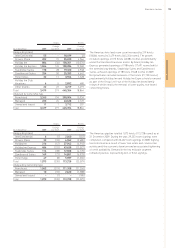

12 months ended 31 December

2009 2008 %

$m $m change

Assessments 1,008 990 1.8 In the year to 31 December 2009, assessments increased by 1.8%

to $1.01bn primarily as a result of the growth in system size and

marketing programmes.

Hotels operated under IHG brands are, pursuant to terms within

their contracts, subject to cash assessments for the provision of

brand marketing, reservations systems and the Priority Club loyalty

programme. These assessments, typically based upon room

revenue, are pooled for the collective benefit of all hotels by

brand or geography into the System Funds (the Funds). The Group

acts on behalf of hotel owners with regard to the Funds, and the

Owners’ Association, the IAHI, provides a governance overview of

the operation of the Funds. The operation of the Funds does not

result in a profit or loss for the Group and consequently the

revenues and expenses of the Funds are not included in the Group

Income Statement.

Exceptional operating items

Exceptional operating items of $373m consisted of:

• $91m charge, comprising an onerous contract provision of

$65m for the future net unavoidable costs under a performance

guarantee related to certain management contracts with one

US hotel owner, and a deposit of $26m written off as it is no

longer considered recoverable under the terms of the same

management contracts;

• $19m in relation to the Holiday Inn brand family relaunch;

• $21m enhanced pension transfers to deferred members of the

InterContinental Hotels UK Pension Plan who accepted an offer

to receive the enhancement as either a cash lump sum or an

additional transfer value to an alternative pension plan provider;

• $197m of non-cash impairment charges reflecting the weaker

trading environment in 2009, including $45m relating to hotels

reclassified from held for sale assets;

• $43m which primarily related to the closure of certain corporate

offices together with severance costs arising from a review of

the Group’s cost base; and

• $2m loss on disposal of hotels.

Exceptional operating items are treated as exceptional by reason

of their size or nature and are excluded from the calculation of

adjusted earnings per ordinary share in order to provide a more

meaningful comparison of performance.

Net financial expenses

Net financial expenses decreased from $101m in 2008 to $54m in

2009, due to lower net debt levels and lower interest rates. Average

net debt levels in 2009 were lower than 2008 primarily as a result

of cost reduction programmes and an increased focus on cash.

Financing costs included $2m (2008 $12m) of interest costs

associated with Priority Club Rewards where interest is charged

on the accumulated balance of cash received in advance of the

redemption points awarded. Financing costs in 2009 also included

$18m (2008 $18m) in respect of the InterContinental Boston

finance lease.

Central

Central results

System Funds

System Fund results

Other financial information

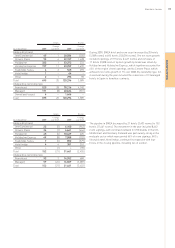

12 months ended 31 December

2009 2008 %

$m $m change

Revenue 124 126 (1.6)

Gross central costs (228) (281) 18.9

Net central costs (104) (155) 32.9

During 2009, net central costs decreased by 32.9% from $155m

to $104m. The significant reduction was driven by management

actions to increase efficiencies and implement cost-saving

measures across the Group. Relative to 2008, the 2009 net central

costs also benefited from a $16m favourable movement in foreign

exchange whilst the 2008 results included the receipt of a

favourable $3m insurance settlement.