Holiday Inn 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review 19

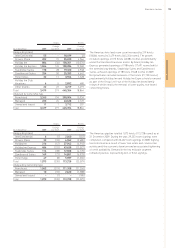

Asia Pacific hotel and room count

Hotels Rooms

Change Change

At 31 December 2009 over 2008 2009 over 2008

Analysed by brand

InterContinental 46 617,036 1,638

Crowne Plaza 71 523,147 1,618

Holiday Inn 102 128,995 1,120

Holiday Inn Express 26 26,464 258

Other 19 (1) 5,387 (259)

Total 264 13 81,029 4,375

Analysed by ownership type

Franchised 34 (8) 7,321 (2,500)

Managed 228 21 73,015 6,875

Owned and leased 2–693 –

Total 264 13 81,029 4,375

Asia Pacific hotel and room count increased by 13 hotels

(4,375 rooms) to 264 hotels (81,029 rooms), including the opening

of 27 hotels (8,334 rooms) offset by the removal of 14 hotels

(3,959 rooms). The growth was predominantly driven by the opening

of 17 hotels (5,776 rooms) in Greater China reflecting continued

expansion in one of IHG’s strategic markets.

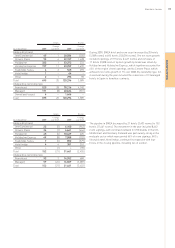

Asia Pacific pipeline

Hotels Rooms

Change Change

At 31 December 2009 over 2008 2009 over 2008

Analysed by brand

InterContinental 34 (2) 12,033 (496)

Crowne Plaza 72 724,952 417

Holiday Inn 77 320,637 (568)

Holiday Inn Express 28 57,230 1,215

Hotel Indigo 21322 142

Total 213 14 65,174 710

Analysed by ownership type

Franchised 2–326 (1)

Managed 211 14 64,848 711

Total 213 14 65,174 710

The pipeline in Asia Pacific increased by 14 hotels (710 rooms)

to 213 hotels (65,174 rooms). Pipeline growth was fuelled by the

Greater China market which generated 75% of the region’s room

signings, followed by India, which contributed a further 16%.

From a brand perspective, Crowne Plaza experienced the highest

demand with 45% of the region’s room signings, followed by

Holiday Inn, which contributed a further 32%. During the year,

the first Hotel Indigo was signed in Hong Kong.

BUSINESS REVIEW