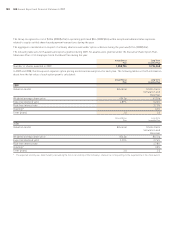

Holiday Inn 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 IHG Annual Report and Financial Statements 2009

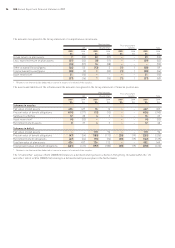

32 Related party disclosures

Key management personnel comprises the Board and Executive Committee.

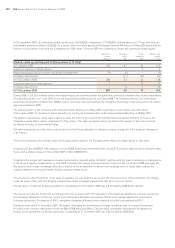

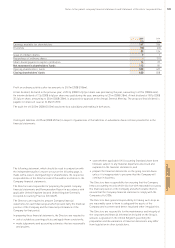

2009 2008

Total compensation of key management personnel $m $m

Short-term employment benefits 9.8 18.4

Post-employment benefits 0.6 0.7

Termination benefits 0.8 –

Equity compensation benefits 9.5 12.8

20.7 31.9

There were no transactions with key management personnel during the year ended 31 December 2009 or the previous year.

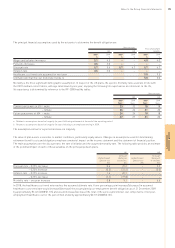

33 System Funds

The Group operates funds to collect and administer assessments from hotel owners for specific use in marketing, the Priority Club loyalty

programme and the global reservation system. The Funds and loyalty programme are accounted for in accordance with the accounting

policies set out on page 69 of the financial statements.

The following information is relevant to the operation of the Funds:

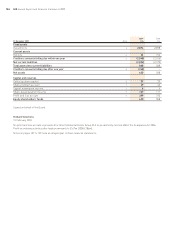

2009 2008

$m $m

Assessment fees received from hotels* 1,008 990

Key elements of Funds’ expenditure:*

Marketing 165 211

Priority Club 210 212

Payroll costs 152 155

Net surplus for the year 43 10

Cumulative short-term net surplus 71 28

Loyalty programme liability 470 471

Interest payable to the Funds 212

* Not included in the Group income statement in accordance with the Group’s accounting policies.

The payroll costs above relate to 4,019 (2008 3,853) employees who are employed by the Funds.

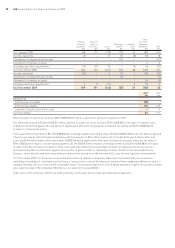

34 Principal operating subsidiary undertakings

InterContinental Hotels Group PLC was the beneficial owner of all of the equity share capital, either itself or through subsidiary

undertakings, of the following companies during the year:

Six Continents Limiteda

Hotel Inter-Continental London Limiteda

Six Continents Hotels, Inc.b

Inter-Continental Hotels Corporationb

Barclay Operating Corp.b

InterContinental Hotels Group Resources, Inc.b

InterContinental Hong Kong Limitedc

Société Nouvelle du Grand Hotel SAd

The companies listed above include those which principally affect the amount of profit and assets of the Group.

a Incorporated in Great Britain and registered in England and Wales.

b Incorporated in the United States.

c Incorporated in Hong Kong.

d Incorporated in France.

Notes to the Group financial statements continued