Holiday Inn 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8IHGAnnual Report and Financial Statements 2009

This Business Review for

the financial year ended

31 December 2009 provides

a review of the business and

strategy of InterContinental

Hotels Group PLC (the Group

or IHG), commentaries on the

development and performance

of the business, employee and

environmental matters and a

description of the risks and

uncertainties impacting

the business.

Business overview

Market and competitive environment

Global economic events and industry cycle

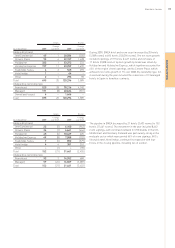

The economic conditions of the last year have had a significant

impact on IHG and the wider hotel industry. We continue to monitor

key trends and business fundamentals, such as revenue per

available room (RevPAR) to ensure our strategy remains well

suited to the developing environment and our capabilities, and we

believe our business is resilient. Accordingly, our strategy remains

unchanged. However, we see short-term risks in the pace of future

openings and the recovery in consumer demand, particularly

business travel.

The downturn continued to be severe in 2009, with a sharp decline

in global industry RevPAR and bookings. Our industry has always

been cyclical and there are signs that business and consumer

confidence is returning and RevPAR is beginning a slow recovery.

Historically as an industry, in previous cycles, we have experienced

periods of five to eight years of RevPAR growth followed by up to

two years of declines in RevPAR. Demand has rarely fallen for

sustained periods and it is the interplay between hotel supply and

demand in the industry that drives longer-term fluctuations in

RevPAR. The difference in the recovery this time is likely to be

slower increases in supply due to the ongoing finance environment

remaining at more ‘normal’ levels compared with 2005 to 2008,

and muted demand recovery as discretionary income growth and

corporate profit growth are held back by, amongst other issues,

tax increases and reduced access to credit. The Group’s fee-based

profit is partly protected from changes in hotel supply or demand

due to its model of third-party ownership of hotels under IHG

franchise and management contracts. IHG profit varies more with

hotel revenue (demand) than it does with hotel profit performance.

Accordingly, IHG’s share price saw some significant recovery and

stabilisation since the lows of last spring. Our share price

increased by 59% in the 12 months to 31 December 2009 and those

of our listed company competitors increased by an average 56%

over the same period. We believe we are well placed over the

coming year compared with competitors who own hotels, rather

than simply operate them, as IHG does.

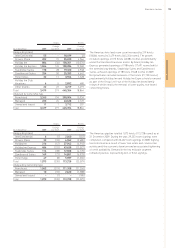

Market size

The global hotel market has an estimated room capacity of

18 million rooms. This has grown at approximately 2% per

annum over the last five years. Competitors in the market include

other hotel companies, both large and small, and independently

owned hotels.

The market remains fragmented, with an estimated eight million

branded hotel rooms (approximately 45% of the total market). IHG

has an estimated 8% share of the branded market (approximately

3% of the total market). The top six major companies, including

IHG, together control approximately 41% of the branded rooms,

only 18% of total hotel rooms.

Geographically, the market is more concentrated with the top

20 countries accounting for more than 80% of global hotel rooms.

Within this, the United States (US) is dominant (approximately 25%

of global hotel rooms) with China, Spain and Italy being the next

largest markets. The Group’s brands have more leadership

positions (top three by room numbers) in the six largest geographic

markets than any other major hotel company.

Drivers of growth

US market data historically indicates a steady increase in hotel

industry revenues, broadly in line with Gross Domestic Product

(GDP), with growth of approximately 1.5% per annum in real terms

since 1967.

Globally, we believe demand is driven by a number of underlying

trends:

• change in demographics – as the population ages and becomes

wealthier, increased leisure time and income encourages more

travel and hotel visits: younger generations are increasingly

seeking work/life balance, with positive implications for

increased leisure travel;

• increase in travel volumes as airline capacity grows and

affordability improves, accentuated in some regions by the

strength of the market positions of low-cost airlines;

• globalisation of trade and tourism;

• increase in affluence and freedom to travel within emerging

markets, such as China and Brazil; and

• increase in the preference for branded hotels amongst consumers.

Branded v unbranded

2009 branded hotel rooms

as a percentage of the total market

US 69%

Europe, Middle East and Africa (EMEA) 34%

Asia Pacific (APAC) 29%

Source: IHG analysis, Smith Travel Research (STR).

Business review