Holiday Inn 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Remuneration report 55

1 This award was based on EPS, EBIT and individual performance measures.

Total shares held include matching shares.

2 This award was based on EPS and EBIT measures. Total shares held include

matching shares.

3 This award was based on Group EBIT and net annual rooms additions

measures. Total shares held include matching shares.

4 This award was based on Group EBIT, net annual rooms additions and

individual performance measures. The bonus target was 57.5% of base

salary. Both Executive Directors were awarded 20.52% for Group EBIT

performance, 10.97% for net annual rooms additions and 30.19% for

individual performance, resulting in a total deferred shares bonus of

61.68% of base salary. No matching shares were awarded.

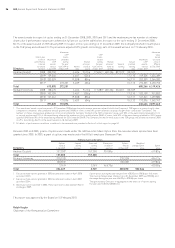

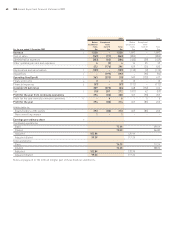

The following table sets out the pension benefits of the Executive Directors.

Andrew Richard

Cosslett Solomons

££

Directors’ contributions in the year139,400 25,100

Transfer value of accrued benefits at 1 January 2009 2,028,600 3,430,800

Transfer value of accrued benefits at 31 December 2009 2,574,100 3,934,700

Increase in transfer value over the year, less Directors’ contributions 506,100 478,800

Absolute increase in accrued pension2(pa) 28,600 20,400

Increase in accrued pension3(pa) 28,600 20,400

Accrued pension at 31 December 20094(pa) 131,200 217,700

Age at 31 December 2009 54 48

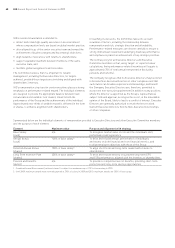

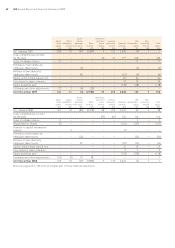

Annual Bonus Plan deferred share awards

Messrs Cosslett and Solomons participated in the ABP during the year ended 31 December 2009. However, no annual bonus is payable

for this period. No matching shares are provided on awards. Directors’ pre-tax share interests during the year were as follows.

ABP Value

Financial ABP shares based

year on awards vested on share

which ABP during Market during Market ABP price of

performance awards the year price per the year price per Value at awards Planned 893p at

is based held at

1 Jan 2009 to

Award share at

1 Jan 2009 to

Vesting share at vesting held at vesting 31 Dec 2009

Directors for award 1 Jan 2009 31 Dec 2009 date award 31 Dec 2009 date vesting £ 31 Dec 2009 date £

Andrew Cosslett 2005 28,87818.3.06 853.67p 28,878 9.3.09 443.93p 128,198

2006 55,870226.2.07 1235p 55,870 26.2.10 498,919

2007 71,287325.2.08 819.67p 71,287 25.2.11 636,593

2008 104,652423.2.09 472.67p 104,652 23.2.12 934,542

Total 156,035 104,652 231,809 2,070,054

Richard Solomons 2005 18,45918.3.06 853.67p 18,459 9.3.09 443.93p 81,945

2006 35,757226.2.07 1235p 35,757 26.2.10 319,310

2007 45,634325.2.08 819.67p 45,634 25.2.11 407,512

2008 66,549423.2.09 472.67p 66,549 23.2.12 594,283

Total 99,850 66,549 147,940 1,321,105

1 Contributions paid in the year by the Directors under the terms

of the plans. Contributions were 5% of full pensionable salary.

2 The absolute increase in accrued pension during the year.

3 The increase in accrued pension during the year, excluding any increase

for inflation.

4 Accrued pension is that which would be paid annually on retirement at 60,

based on service to 31 December 2009.

THE BOARD,

SENIOR MANAGEMENT AND

THEIR RESPONSIBILITIES