Holiday Inn 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP FINANCIAL

STATEMENTS

Notes to the Group financial statements 77

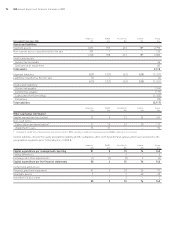

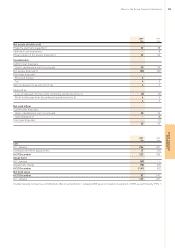

5 Exceptional items

2009 2008

Note $m $m

Continuing operations

Exceptional operating items:

Cost of sales:

Onerous management contracts a(91) –

Administrative expenses:

Holiday Inn brand relaunch b(19) (35)

Reorganisation and related costs c(43) (24)

Enhanced pension transfer d(21) –

(83) (59)

Other operating income and expenses:

Gain on sale of associate investments –13

Gain on sale of other financial assets –14

Loss on disposal of hotels (note 11)* (2) (2)

(2) 25

Depreciation and amortisation:

Reorganisation and related costs c–(2)

Impairment:

Property, plant and equipment (note 10) (28) (12)

Assets held for sale (note 11) (45) –

Goodwill (note 12) (78) (63)

Intangible assets (note 13) (32) (21)

Other financial assets (note 15) (14) –

(197) (96)

(373) (132)

Tax:

Tax on exceptional operating items 112 17

Exceptional tax credit e175 25

287 42

Discontinued operations

Gain on disposal of assets (note 11):

Gain on disposal of hotels** 2–

Tax credit 45

f65

* Relates to hotels classified as continuing operations.

** Relates to hotels classified as discontinued operations.

The above items are treated as exceptional by reason of their size or nature.

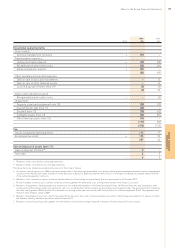

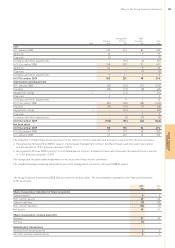

a An onerous contract provision of $65m has been recognised for the future net unavoidable costs under a performance guarantee related to certain management

contracts with one US hotel owner. In addition to the provision, a deposit of $26m has been written off as it is no longer considered recoverable under the terms

of the same management contracts.

b Relates to costs incurred in support of the worldwide relaunch of the Holiday Inn brand family that was announced on 24 October 2007.

c Primarily relates to the closure of certain corporate offices together with severance costs arising from a review of the Group’s cost base.

d Relates to the payment of enhanced pension transfers to those deferred members of the InterContinental Hotels UK Pension Plan who had accepted an offer

to receive the enhancement either as a cash lump sum or as an additional transfer value to an alternative pension plan provider. The exceptional item comprises

the lump sum payments ($9m), the IAS 19 settlement loss arising on the pension transfers ($11m) and the costs of the arrangement ($1m). The payments and

transfers were made in January 2009.

e Relates to the release of provisions which are exceptional by reason of their size or nature relating to tax matters which have been settled or in respect of which

the relevant statutory limitation period has expired (see note 7).

f Relates to tax arising on disposals together with the release of provisions no longer required in respect of hotels disposed of in prior years.