Holiday Inn 2009 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review 21

Taxation

The effective rate of tax on the combined profit from continuing and

discontinued operations, excluding the impact of exceptional items,

was 5% (2008 23%). The rate is particularly low in 2009 due to the

impact of prior year items relative to a lower level of profit than in

2008. By excluding the impact of prior year items, which are

included wholly within continuing operations, the equivalent tax

rate would be 42% (2008 39%). This rate is higher than the UK

statutory rate of 28% due mainly to certain overseas profits

(particularly in the US) being subject to statutory rates higher

than the UK statutory rate, unrelieved foreign taxes and

disallowable expenses.

Taxation within exceptional items totalled a credit of $287m

(2008 $42m) in respect of continuing operations. This represented

the release of exceptional provisions relating to tax matters

which were settled during the year, or in respect of which the

statutory limitation period had expired, together with tax relief

on exceptional costs.

Net tax paid in 2009 totalled $2m (2008 $2m) including $1m (2008

$3m) in respect of disposals. Tax paid is lower than the current

period income tax charge, primarily due to the receipt of refunds in

respect of prior years, together with provisions for tax for which no

payment of tax has currently been made.

Earnings per ordinary share

Basic earnings per ordinary share in 2009 was 74.7¢, compared

with 91.3¢ in 2008. Adjusted earnings per ordinary share was

102.8¢, against 120.9¢ in 2008.

Dividends

The Board has proposed a final dividend per ordinary share of

29.2¢ (18.7p). With the interim dividend per ordinary share of 12.2¢

(7.3p), the full-year dividend per ordinary share for 2009 will total

41.4¢ (26.0p).

Share price and market capitalisation

The IHG share price closed at £8.93 on 31 December 2009, up from

£5.62 on 31 December 2008. The market capitalisation of the Group

at the year end was £2.6bn.

Capital structure and liquidity management

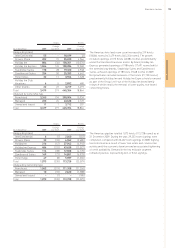

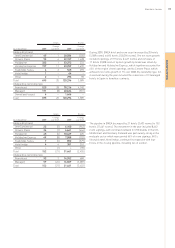

2009 2008

Net debt at 31 December $m $m

Borrowings

Sterling* –152

US dollar* 866 889

Euro 216 224

Other 53 90

Cash* (53) (82)

Net debt 1,082 1,273

Average debt levels 1,231 1,498

* Including the impact of currency derivatives.

2009 2008

Facilities at 31 December $m $m

Committed 1,693 2,107

Uncommitted 25 25

Total 1,718 2,132

Interest risk profile of gross debt 2009 2008

for major currencies at 31 December %%

At fixed rates 90 53

At variable rates 10 47

In response to the challenging economic environment the Group

continued its focus on cash management during 2009. In the year,

$432m of cash was generated from operating activities, with the

other key elements of the cash flow being:

• proceeds from the disposal of hotels and investments of

$35m; and

• capital expenditure of $148m, including $65m to purchase the

Hotel Indigo San Diego.

The Group is mainly funded by a $1.7bn syndicated bank facility,

of which $1.6bn matures in May 2013 and an $85m term loan

that matures in November 2010.

In December 2009, the Group issued a seven-year £250m public

bond, at a coupon of 6%, which was initially priced at 99.465% of

face value. The £250m was immediately swapped into US dollar

debt using currency swaps and the proceeds were used to reduce

the term loan which matures in November 2010 from $500m to

$85m. Additional funding is provided by a finance lease on the

InterContinental Boston.

Net debt at 31 December 2009 decreased by $191m to $1,082m

and, in the table above, included $204m in respect of the finance

lease commitment for the InterContinental Boston and $415m

in respect of currency swaps related to the sterling bond.

Further information on the Group’s treasury management can

be found in note 22 on pages 89 and 90 in the notes to the Group

financial statements 2009.

BUSINESS REVIEW

Other financial information continued