Holiday Inn 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 IHG Annual Report and Financial Statements 2009

Remuneration report continued

Each year, specific quantitative targets against individual

performance measures are set for each Executive Director

and Executive Committee member, as relevant to their role.

Performance against these measures is reviewed at the end

of each year to determine bonus outcomes.

In 2009, under the financial measure (EBIT), threshold payout

was 90% of target performance, with maximum payout at 110%

or more of target. Payout for individual performance would be

reduced by half if EBIT performance was below threshold.

In addition, no annual bonus would be payable on any measure

if EBIT performance was lower than 85% of target.

Outcomes in 2009

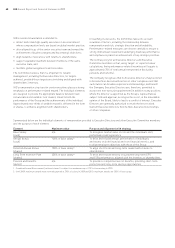

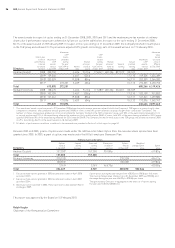

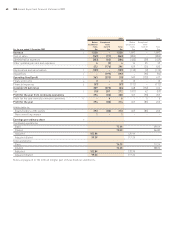

The following table shows the performance in 2009 against KPOs.

Measure Key performance indicator Payout as % of salary

Target Max

2

Actual

Financial (70%) EBIT 80.5 161 Zero

Individual (30%) OPR

1

– Andrew Cosslett 34.5 69 Zero

OPR

1

– Richard Solomons 34.5 69 Zero

1 Overall Performance Rating for individual performance.

2 Combined EBIT and OPR payout, subject to a maximum of 200%

of base salary.

Structure in 2010

The Annual Bonus structure remains largely unchanged in 2010

with awards under the ABP continuing to require the achievement

of challenging performance goals before target bonus is payable.

A summary of the operation of the 2010 ABP is shown below.

However, reflecting the increased focus on cost control and the

continued challenging market conditions, the maximum bonus

opportunity for the Executive Directors will be capped at 175% of

salary (previously 200%) for 2010 only. In addition, the stretch EBIT

target for maximum bonus payment will be increased to 120% of

budget for 2010, from 110% in previous years.

As with previous years, the achievement of target performance will

result in a bonus of 115% of salary. Half of any bonus earned will

be deferred in the form of shares for three years.

5 Long Term Incentive Plan (LTIP)

The LTIP allows Executive Directors and eligible management

employees to receive share awards, subject to the achievement of

performance conditions set by the Committee, normally measured

over a three-year period. Awards are made annually and, other

than in exceptional circumstances, will not exceed three times

annual salary for Executive Directors.

Structure for 2009/2011 cycle

Prior to 2009, awards to Executive Directors were normally made

at the level of 270% of salary. In light of the cost-constrained

environment in which IHG currently operates, awards for 2009

were made at 205% of salary.

The performance conditions for the cycle are:

• IHG’s TSR relative to the Dow Jones World Hotels index

(two-thirds of the award); and

• growth in adjusted EPS over the period (one-third of the award).

Awards under the LTIP lapse if performance conditions are not met

– there is no re-testing.

Performance conditions for all outstanding awards are shown in

the table on page 51.

Structure for 2010/2012 cycle

The LTIP structure remains relatively consistent for the 2010/2012

cycle, with the reduced award level for 2009 maintained.

Performance conditions will remain TSR relative to the Dow Jones

World Hotels index and growth in adjusted EPS over the period.

However, these two measures will be equally weighted for

this cycle.

A summary of the operation of the 2010/2012 LTIP cycle is

shown below.

In setting the performance targets, the Committee has taken

into account a range of factors, including IHG’s strategic plans,

analysts’ expectations for IHG’s performance and for the industry

as a whole, the historical performance of the industry and

FTSE 100 market practice. The targets selected are shown

in the table below.

Required TSR

relative to Dow

% of award Required Jones World

Performance vesting EPS growth Hotels index

Threshold 20% 5% pa Match index

Maximum 100% 15% pa Index + 8% pa

EPS performance henceforth will be measured on a constant tax

rate across the cycle due to the impact that short-term fluctuations

in tax rates have on vesting outcomes. Optimisation of tax rates

remains a key area of focus for relevant management.

Performance

measures Structure

LTIP

2010/2012

50%

EPS

100%

Shares

50%

TSR

Performance

measures Structure

Annual

Bonus

for 2010

70%

EBIT

50%

Cash

30%

Individual

50%

Deferred

Shares