Cigna 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

The parent normally meets its liquidity requirements by:

• maintaining appropriate levels of cash, cash equivalents and short-term investments;

• collecting dividends from its subsidiaries;

• using proceeds from issuance of debt and equity securities;

• collecting pension contributions from subsidiaries in the amount of the GAAP expense charged; and

• borrowing from its subsidiaries.

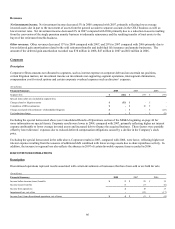

Cash flows for the years ended December 31, were as follows:

(In millions) 2008 2007 2006

Operating activities $ 1,656 $ 1,342 $ 642

Investing activities $(2,572) $ 269 $ 1,548

Financing activities $ 314 $ (1,041) $(2,513)

Cash flow from operating activities consists of cash receipts and disbursements for premiums and fees, gains (losses) recognized in

connection with the Company’s GMDB equity hedge program, investment income, taxes, and benefits and expenses.

Because certain income and expense transactions do not generate cash, and because cash transactions related to revenue and expenses

may occur in periods different from when those revenues and expenses are recognized in net income, cash flow from operating

activities can be significantly different from net income. The Company assesses cash flows from operating activities by comparing it

with adjusted income from operations, which is defined as income from continuing operations excluding the results of GMIB and

special items, and further adjusted to exclude pre-tax realized investment results and depreciation and amortization charges.

Cash flows from investing activities generally consist of net investment purchases or sales and net purchases of property and

equipment, which includes capitalized software, as well as cash used to acquire businesses.

Cash flows from financing activities is generally comprised of issuances and re-payment of debt at the parent level, proceeds on the

issuance of common stock resulting from stock option exercises, and stock repurchases. In addition, the subsidiaries report net

deposits/withdrawals to/from investment contract liabilities (which include universal life insurance liabilities) because such liabilities

are considered financing activities with policyholders.

2008:

Operating activities

For the year ended December 31, 2008, cash flows from operating activities were greater than adjusted income from operations by

$406 million, including cash inflows of $333 million associated with the GMDB equity hedge program which did not affect net

income. Excluding those inflows, cash flows from operating activities were higher than adjusted income from operations by $73

million, primarily reflecting favorable receivable collections and increases in GMDB reserves due to the 2008 charges. These factors

were partially offset by payments for certain prepaid expenses and litigation matters.

Cash flows from operating activities increased by $314 million in 2008 compared with 2007. Excluding the results of the GMDB

equity hedge program (which did not affect net income), cash flows from operating activities decreased by $51 million. This

decrease in 2008 primarily reflects higher payments for certain prepaid expenses in 2008.

Investing activities

The Company used net cash of $1.3 billion to fund the acquisition of Great-West Healthcare, consisting of a cash payment to Great-

West Life and Annuity, Inc. of approximately $1.4 billion, partially offset by cash acquired from Great-West Healthcare of

approximately $0.1 billion. Excluding this item, cash used in investing activities was $1.3 billion. This use of cash primarily

consisted of net purchases of investments of $988 million and net purchases of property and equipment of $257 million.

Financing activities

Cash provided from financing activities primarily consisted of proceeds from the net issuance of short-term debt of $298 million and

long-term debt of $297 million. These borrowing arrangements were entered into for general corporate purposes, including the