Cigna 2008 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.130

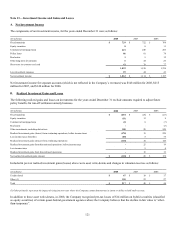

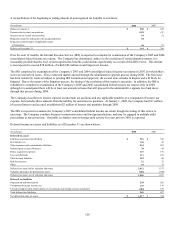

Note 20 — Leases, Rentals and Outsourced Service Arrangements

Rental expenses for operating leases, principally for office space, amounted to $131 million in 2008, $114 million in 2007 and

$104 million in 2006. As of December 31, 2008, future net minimum rental payments under non-cancelable operating leases were

approximately $535 million, payable as follows (in millions): $121 in 2009, $111 in 2010, $89 in 2011, $63 in 2012, $44 in 2013 and

$107 thereafter.

The Company also has several outsourced service arrangements with third parties, primarily for human resource and information

technology support services. The initial service periods under these arrangements range from 2 to 7 years and their related costs are

reported consistent with operating leases over the service period based on the pattern of use. The Company recorded in other

operating expense $113 million in 2008, $87 million in 2007 and $24 million in 2006 for these arrangements.

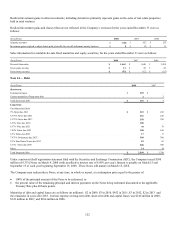

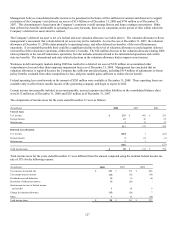

Note 21 ― Segment Information

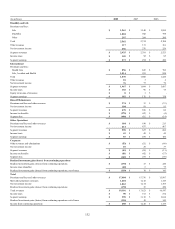

The Company's operating segments generally reflect groups of related products, except for the International segment which is

generally based on geography. In accordance with GAAP, operating segments that do not require separate disclosure may be

combined. The Company measures the financial results of its segments using “segment earnings (loss),” which is defined as income

(loss) from continuing operations excluding after-tax realized investment gains and losses.

Consolidated pre-tax income from continuing operations is primarily attributable to domestic operations. Consolidated pre-tax income

from continuing operations generated by the Company's foreign operations was approximately 36% in 2008, and 11% in 2007 and 8%

in 2006.

The Company determines segment earnings (loss) consistent with the accounting policies for the consolidated financial statements,

except that amounts included in Corporate are not allocated to segments. The Company allocates certain other operating expenses,

such as systems and other key corporate overhead expenses, on systematic bases. Income taxes are generally computed as if each

segment were filing a separate income tax return. The Company does not report total assets by segment since this is not a metric used

to allocate resources or evaluate segment performance.

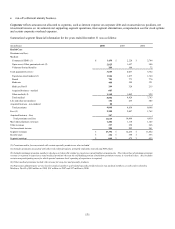

The Company presents segment information as follows:

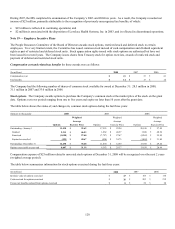

Health Care includes medical, dental, behavioral health, prescription drug and other products and services that may be integrated to

support consumer-focused health care programs. This segment also includes group disability and life insurance products that were

historically sold in connection with certain experience-rated medical products.

Disability and Life includes group:

• disability insurance;

• disability and workers’ compensation case management;

• life insurance;

• accident; and

• specialty insurance.

International includes:

• life, accident and supplemental health insurance products; and

• international health care products and services including those offered to expatriate employees of multinational corporations.

Run-off Reinsurance includes accident, workers’ compensation, international life and health, guaranteed minimum death benefit and

guaranteed minimum income benefit reinsurance businesses. The Company stopped underwriting new reinsurance business in 2000.

The Company also reports results in two other categories.

Other Operations consist of:

• non-leveraged and leveraged corporate-owned life insurance (COLI);

• deferred gains recognized from the 1998 sale of the individual life insurance and annuity business and the 2004 sale of the

retirement benefits business; and