Cigna 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

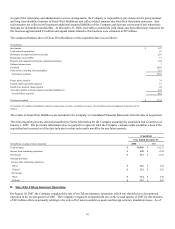

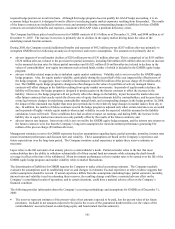

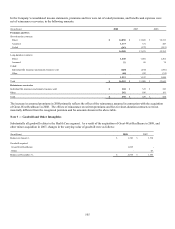

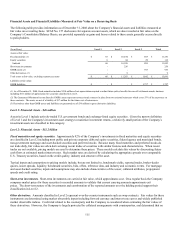

The Company measures the assets and obligations of its domestic pension and other postretirement benefit plans as of December 31.

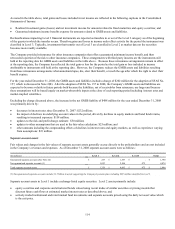

The following table summarizes the projected obligations and assets related to the Company's domestic and international pension and

other postretirement benefit plans as of, and for the years ended, December 31:

Other

Pension Postretirement

Benefits Benefits

(In millions) 2008 2007 2008 2007

Change in benefit obligation

Benefit obligation, January 1 $ 4,045 $ 4,186 $ 426 $ 465

Service cost 74 73 1 2

Interest cost 242 231 24 24

(Gain) loss from past experience 13 (99) (20) (31)

Benefits paid from plan assets (246) (251) (3) (3)

Benefits paid - other (24) (36) (36) (31)

Translation of foreign currencies (3) - - -

Amendments - (59) (16) -

Benefit obligation, December 31 4,101 4,045 376 426

Change in plan assets

Fair value of plan assets, January 1 3,417 3,343 28 30

Actual return on plan assets (921) 321 (1) 1

Benefits paid (246) (251) (3) (3)

Translation of foreign currencies (4) - - -

Contributions 2 4 - -

Fair value of plan assets, December 31 2,248 3,417 24 28

Funded Status $(1,853) $ (628) $(352) $(398)

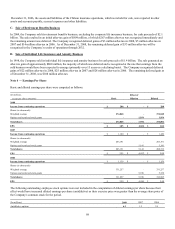

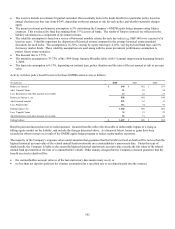

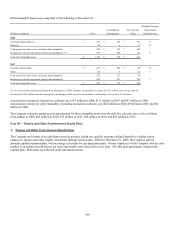

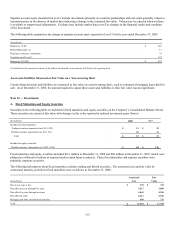

The postretirement benefits liability adjustment included in accumulated other comprehensive loss consisted of the following as of

December 31:

Pension Other

Benefits Postretirement Benefits

(In millions) 2008 2007 2008 2007

Unrecognized net gain (loss) $(1,548) $ (437) $ 84 $ 74

Unrecognized prior service cost 50 61 88 89

Postretirement benefits liability adjustment $(1,498) $ (376) $ 172 $ 163

During 2008, the Company’s postretirement benefits liability adjustment increased by $1.1 billion pre-tax ($723 million after-tax)

resulting in a decrease to shareholders’ equity. The increase in the liability was primarily due to the difference between expected and

actual returns on pension plan assets. Those investments experienced significant losses in 2008 due to the decline in the equity

markets, compared with the expected long-term returns of 8% assumed in the expense calculation. Partially offsetting these losses

was the amortization of actuarial losses.

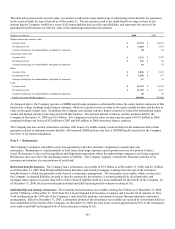

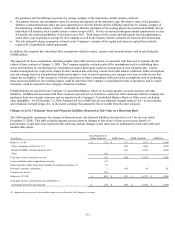

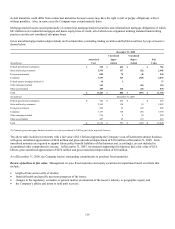

Pension benefits. The Company’s pension plans were underfunded by $1.9 billion in 2008 and $628 million in 2007 and had related

accumulated benefit obligations of $4.1 billion as of December 31, 2008 and $4.0 billion as of December 31, 2007.

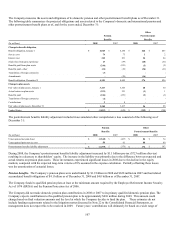

The Company funds its qualified pension plans at least at the minimum amount required by the Employee Retirement Income Security

Act of 1974 (ERISA) and the Pension Protection Act of 2006.

The Company did not make domestic pension plan contributions in 2008 or 2007 to its primary qualified domestic pension plan. The

Company expects contributions to the qualified pension plan to be approximately $410 million during 2009. This amount could

change based on final valuation amounts and the level at which the Company decides to fund the plan. These estimates do not

include funding requirements related to the litigation matter discussed in Note 22 to the Consolidated Financial Statements, as

management does not expect this to be resolved in 2009. Future years’ contributions will ultimately be based on a wide range of