Cigna 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

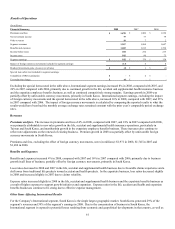

Discontinued operations for 2008 primarily represents a gain of $3 million after-tax from the settlement of certain issues related to a

past divestiture.

For 2007 and 2006, discontinued operations primarily reflects:

• impairment losses related to the dispositions in 2007 and 2006 of several Latin American insurance operations as discussed in

Note 3 to the Consolidated Financial Statements; and

• realized gains on the disposition of certain directly-owned real estate investments in 2007 and 2006 as discussed in Note 13 to

the Consolidated Financial Statements.

INDUSTRY DEVELOPMENTS AND OTHER MATTERS

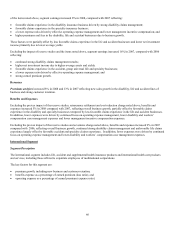

The disability industry is under continuing review by regulators and legislators with respect to its offset practices regarding Social

Security Disability Insurance (“SSDI”). There has been specific inquiry as to the industry’s role in assisting individuals with their

applications for SSDI. The Company has received one Congressional inquiry and has responded to the information request. Also,

legislation prohibiting the offset of SSDI payments against private disability insurance payments for prospectively issued policies has

been introduced in the Connecticut state legislature. The Company is also involved in related pending litigation. If the industry is

forced to change its offset SSDI procedures, the practices and products for the Company’s Disability & Life segment could be

significantly impacted.

There are certain other matters that present significant uncertainty, which could result in a material adverse impact on the Company's

consolidated results of operations. See Note 22 to the Consolidated Financial Statements for further information.

LIQUIDITY AND CAPITAL RESOURCES

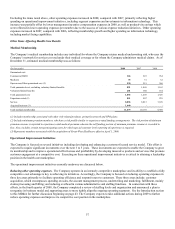

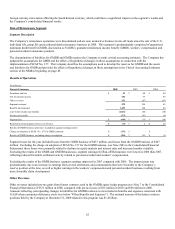

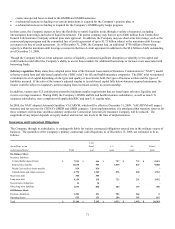

(In millions)

Financial Summary 2008 2007 2006

Short-term investments $ 236 $ 21 $ 89

Cash and cash equivalents $ 1,342 $ 1,970 $ 1,392

Short-term debt $ 301 $ 3 $ 382

Long-term debt $ 2,090 $ 1,790 $ 1,294

Shareholders' equity $ 3,592 $ 4,748 $ 4,330

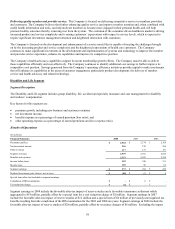

Liquidity

The Company maintains liquidity at two levels: the subsidiary level and the parent company level.

Liquidity requirements at the subsidiary level generally consist of:

• claim and benefit payments to policyholders; and

• operating expense requirements, primarily for employee compensation and benefits.

The Company’s subsidiaries normally meet their operating requirements by:

• maintaining appropriate levels of cash, cash equivalents and short-term investments;

• using cash flows from operating activities;

• selling investments;

• matching investment maturities to the estimated duration of the related insurance and contractholder liabilities; and

• borrowing from its parent company.

Liquidity requirements at the parent level generally consist of:

• debt service and dividend payments to shareholders; and

• pension plan funding.