Cigna 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

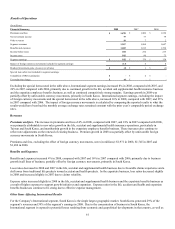

53

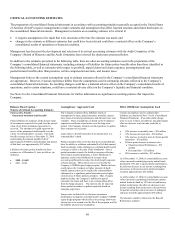

Balance Sheet Caption /

Nature of Critical Accounting Estimate

Assumptions / Approach Used

Effect if Different Assumptions Used

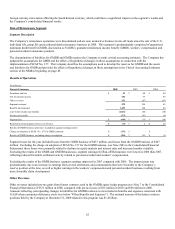

The significant decline in value of equity securities during

2008 has resulted in an accumulated unrecognized actuarial

loss of $1.5 billion at December 31, 2008. The actuarial loss

is adjusted for unrecognized changes in market-related asset

values and amortized over the remaining service life of

pension plan participants if the adjusted loss exceeds 10% of

the market-related value of plan assets or 10% of the

projected benefit obligation, whichever is greater. As of

December 31, 2008, approximately $0.4 billion of the

adjusted actuarial loss exceeded 10% of the projected benefit

obligation. As a result, approximately $35 million after-tax

will be expensed in 2009 net income. For the year ended

December 31, 2008, $37 million after-tax was expensed in

net income.

increase by approximately $10 million, after-tax.

If the December 31, 2008 fair values of domestic

qualified plan assets decreased by 10%, the accrued

pension benefit liability would increase by

approximately $225 million as of December 31,

2008 resulting in an after-tax decrease to

shareholders’ equity of approximately $145 million.

A favorable change is an increase in these key

assumptions and would result in impacts to annual

pension costs, the accrued pension liability and

shareholders’ equity in an opposite direction, but

similar amounts.

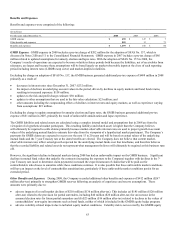

Investments – Fixed maturities

Recognition of losses from “other

than temporary” impairments of

public and private placement

fixed maturities

Losses for “other than temporary” impairments of

fixed maturities must be recognized in net income

based on an estimate of fair value by management.

Changes in fair value are reflected as an increase or

decrease in shareholders’ equity. A decrease in fair

value is recognized in net income when the

decrease is determined to be “other than

temporary.”

Determining whether a decline in value is “other

than temporary” includes an evaluation of the

reasons for and the significance of the decrease in

value of the security as well as the duration of the

decrease.

Management estimates the amount of an “other than

temporary” impairment when a decline in value is expected

to persist, using quoted market prices for public securities

with active markets and generally the present value of future

cash flows for private placement bonds and other public

securities. Expected future cash flows are based on

historical experience of the issuer and management’s

expectation of future performance. See “Quality Ratings” in

the Investment Assets section of the MD&A beginning on

page 73 for additional information.

The Company recognized "other than temporary"

impairments of investments in fixed maturities as follows (in

millions, after-tax):

• 2008 – $138

• 2007 – $20

• 2006 -- $18

See Note 12(A) to the Consolidated Financial Statements for

a discussion of the Company’s review of declines in fair

value.

For all fixed maturities with cost in excess of their

fair value, if this excess was determined to be other-

than-temporary, the Company's net income for the

year ended December 31, 2008 would have

decreased by approximately $388 million after-tax.

For private placement bonds considered impaired, a

decrease of 10% of all expected future cash flows

for the impaired bonds would reduce net income by

approximately $1 million after-tax.