Cigna 2008 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

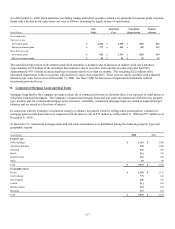

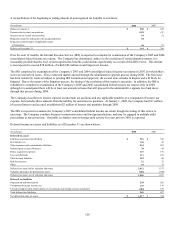

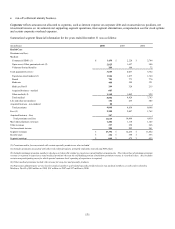

Management believes consolidated taxable income to be generated in the future will be sufficient in amount and character to support

realization of the Company’s net deferred tax assets of $1.6 billion as of December 31, 2008 and $794 million as of December 31,

2007. This determination is based upon the Company’s consistent overall earnings history and future earnings expectations. Other

than deferred tax benefits attributable to operating loss carry forwards, there are no constraints on the period of time within which the

Company’s deferred tax assets must be realized.

The Company’s deferred tax asset is net of a federal and state valuation allowance (see table above). The valuation allowance reflects

management’s assessment that certain deferred tax assets may not be realizable. As was the case at December 31, 2007, the valuation

allowance at December 31, 2008 relates primarily to operating losses, and other deferred tax benefits, of the run-off reinsurance

operations. It is reasonably possible there could be a significant decline in the level of valuation allowance recorded against deferred

tax benefits of the reinsurance operations within the next 12 months. The $24 million decrease in the valuation allowance during 2008

relates primarily to the run-off reinsurance operations, but also includes amounts related to the international operations and certain

state tax benefits. The international and state related reductions in the valuation allowance had no impact on net income.

Weakness in debt and equity markets during 2008 has resulted in a deferred tax asset of $238 million on accumulated other

comprehensive loss and other than temporary impairment losses as of December 31, 2008. Management has concluded that no

valuation allowance is required because the Company has sufficient unrealized gains, including $514 million of adjustments to future

policy benefits excluded from other comprehensive loss, and prior taxable gains sufficient to realize the tax benefit.

Federal operating loss carryforwards in the amount of $283 million were available at December 31, 2008. These operating losses are

available only to offset future taxable income of the generating company, and begin to expire in 2022.

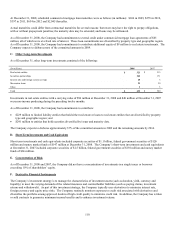

Current income taxes payable included in accounts payable, accrued expenses and other liabilities in the consolidated balance sheet

were $152 million as of December 31, 2008 and $236 million as of December 31, 2007.

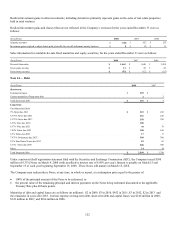

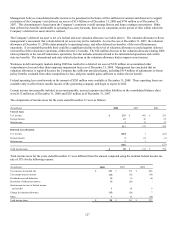

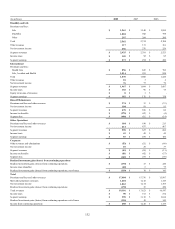

The components of income taxes for the years ended December 31 were as follows:

(In millions) 2008 2007 2006

Current taxes

U.S. income $ 253 $ 462 $ 553

Foreign income 57 36 25

State income 1 13 17

311 511 595

Deferred taxes (benefits)

U.S. income (224) 1 (22)

Foreign income 2 (2) (1)

State income 1 1 -

(221) - (23)

Total income taxes $ 90 $ 511 $ 572

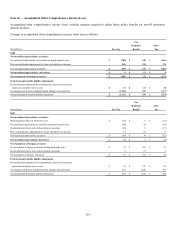

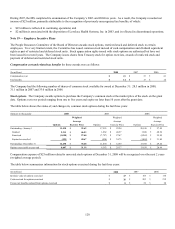

Total income taxes for the years ended December 31 were different from the amount computed using the nominal federal income tax

rate of 35% for the following reasons:

(In millions) 2008 2007 2006

Tax expense at nominal rate $ 133 $ 571 $ 606

Tax-exempt interest income (32) (32) (34)

Dividends received deduction (3) (3) (6)

Resolution of federal tax matters (1) (26) -

State income tax (net of federal income

tax benefit) 1 10 9

Change in valuation allowance (15) (24) 7

Other 7 15 (10)

Total income taxes $ 90 $ 511 $ 572