Cigna 2008 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133

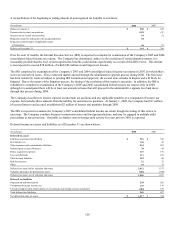

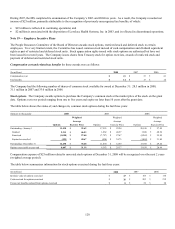

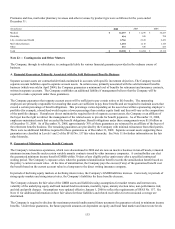

Premiums and fees, mail order pharmacy revenues and other revenues by product type were as follows for the years ended

December 31:

(In millions) 2008 2007 2006

Medical $ 12,287 $ 11,276 $ 10,227

Disability 994 945 798

Life, Accident and Health 2,766 2,619 2,439

Mail order pharmacy 1,204 1,118 1,145

Other 957 536 523

Total $ 18,208 $ 16,494 $ 15,132

Note 22 ― Contingencies and Other Matters

The Company, through its subsidiaries, is contingently liable for various financial guarantees provided in the ordinary course of

business.

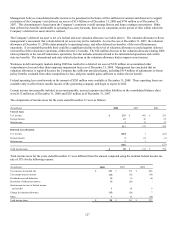

A. Financial Guarantees Primarily Associated with the Sold Retirement Benefits Business

Separate account assets are contractholder funds maintained in accounts with specific investment objectives. The Company records

separate account liabilities equal to separate account assets. In certain cases, primarily associated with the sold retirement benefits

business (which was sold in April 2004), the Company guarantees a minimum level of benefits for retirement and insurance contracts,

written in separate accounts. The Company establishes an additional liability if management believes that the Company will be

required to make a payment under these guarantees.

The Company guarantees that separate account assets will be sufficient to pay certain retiree or life benefits. The sponsoring

employers are primarily responsible for ensuring that assets are sufficient to pay these benefits and are required to maintain assets that

exceed a certain percentage of benefit obligations. This percentage varies depending on the asset class within a sponsoring employer’s

portfolio (for example, a bond fund would require a lower percentage than a riskier equity fund) and thus will vary as the composition

of the portfolio changes. If employers do not maintain the required levels of separate account assets, the Company or an affiliate of

the buyer has the right to redirect the management of the related assets to provide for benefit payments. As of December 31, 2008,

employers maintained assets that exceeded the benefit obligations. Benefit obligations under these arrangements were $1.8 billion as

of December 31, 2008. As of December 31, 2008, approximately 76% of these guarantees are reinsured by an affiliate of the buyer of

the retirement benefits business. The remaining guarantees are provided by the Company with minimal reinsurance from third parties.

There were no additional liabilities required for these guarantees as of December 31, 2008. Separate account assets supporting these

guarantees are classified in Levels 1 and 2 of the SFAS No. 157 fair value hierarchy. See Note 11 for further information on the fair

value hierarchy.

B. Guaranteed Minimum Income Benefit Contracts

The Company's reinsurance operations, which were discontinued in 2000 and are now an inactive business in run-off mode, reinsured

minimum income benefits under certain variable annuity contracts issued by other insurance companies. A contractholder can elect

the guaranteed minimum income benefit (GMIB) within 30 days of any eligible policy anniversary after a specified contractual

waiting period. The Company’s exposure arises when the guaranteed annuitization benefit exceeds the annuitization benefit based on

the policy’s current account value. At the time of annuitization, the Company pays the excess (if any) of the guaranteed benefit over

the benefit based on the current account value in a lump sum to the direct writing insurance company.

In periods of declining equity markets or declining interest rates, the Company’s GMIB liabilities increase. Conversely, in periods of

rising equity markets and rising interest rates, the Company’s liabilities for these benefits decrease.

The Company estimates the fair value of the GMIB assets and liabilities using assumptions for market returns and interest rates,

volatility of the underlying equity and bond mutual fund investments, mortality, lapse, annuity election rates, non-performance risk,

and risk and profit charges. Assumptions were updated effective January 1, 2008 to reflect the requirements of SFAS No. 157. See

Note 11 for additional information on how fair values for these liabilities and related receivables for retrocessional coverage are

determined.

The Company is required to disclose the maximum potential undiscounted future payments for guarantees related to minimum income

benefits. Under these guarantees, the future payment amounts are dependent on equity and bond fund market and interest rate levels