Cigna 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

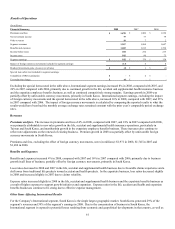

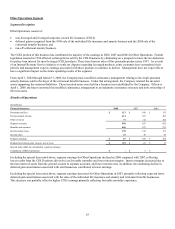

Revenues

Net investment income. Net investment income decreased 5% in 2008 compared with 2007, primarily reflecting lower average

invested assets due in part to the movement of assets from the general account to separate accounts in the COLI business as well as

lower interest rates. Net investment income decreased 6% in 2007 compared with 2006 primarily due to a reduction in assets resulting

from the conversion of the single premium annuity business to indemnity reinsurance and the resulting transfer of trust assets to the

buyer of the retirement benefits business.

Other revenues. Other revenues decreased 13% in 2008 compared with 2007, and 20% in 2007 compared with 2006 primarily due to

lower deferred gain amortization related to the sold retirement benefits and individual life insurance and annuity businesses. The

amount of the deferred gain amortization recorded was $38 million in 2008, $47 million in 2007 and $62 million in 2006.

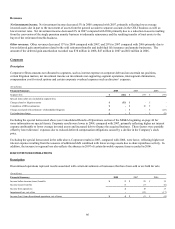

Corporate

Description

Corporate reflects amounts not allocated to segments, such as interest expense on corporate debt and on uncertain tax positions,

certain litigation matters, net investment income on investments not supporting segment operations, intersegment eliminations,

compensation cost for stock options and certain corporate overhead expenses such as directors’ expenses.

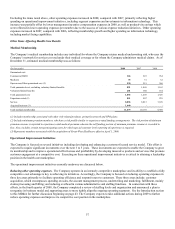

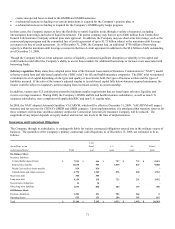

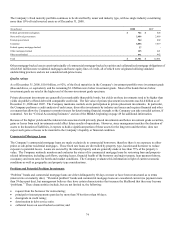

(In millions)

Financial Summary 2008 2007 2006

Segment loss $(162) $(97) $(95)

Special items (after-tax) included in segment loss:

Charge related to litigation matter $(52) $ - $ -

Completion of IRS examination $ - $ 10 $ -

Charge associated with settlement of shareholder litigation $ - $ - $(25)

Cost reduction charge $ - $ - $(8)

Excluding the special items noted above (see Consolidated Results of Operations section of the MD&A beginning on page 46 for

more information on special items), Corporate results were lower in 2008, compared with 2007, primarily reflecting higher net interest

expense attributable to lower average invested assets and increased debt to finance the acquired business. These factors were partially

offset by lower directors’ expenses due to reduced deferred compensation obligations caused by a decline in the Company’s stock

price.

Excluding the special items noted in the table above, Corporate results in 2007, compared with 2006, were lower, reflecting higher net

interest expense resulting from the issuance of additional debt combined with lower average assets due to share repurchase activity. In

addition, the increase in segment loss also reflects the absence in 2007 of certain favorable expense items recorded in 2006.

DISCONTINUED OPERATIONS

Description

Discontinued operations represent results associated with certain investments or businesses that have been sold or are held for sale.

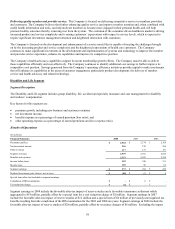

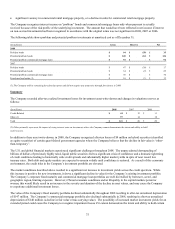

(In millions)

Financial Summary 2008 2007 2006

Income before income (taxes) benefits $ 3 $ 25 $ 19

Income (taxes) benefits 1 (7) (6)

Income from operations 4 18 13

Impairment loss, net of tax - (23) (17)

Income (loss) from discontinued operations, net of taxes $ 4 $(5) $(4)